Part of the big delusion in our banking system is the reality that debt has become a large source of money flowing through the economy. This is why housing made the perfect vessel for Wall Street and banking speculation. Banks create money by issuing loans and there is nothing larger to loan on than a home. Think about the fact that banks were giving out $500,000 for trashy run down homes overrun with rats and this was something that they were booking on their balance sheet as an asset. The FDIC and other regulators simply sat back and watched as the wolves ate the financial chickens at the roost. Many Americans think that banks actually have the money in a vault when they make a loan. They do not. Just like Houdini the illusion is what is powerful. In fact, the FDIC has an insurance fund that is close to negative and this institution is supposed to back up over $7 trillion in saving deposits. How is that even possible? Only when a world is blindly accepting to a banking system and believe the media jargon that banking is too complicated for them to understand. This is what the central and investment banks want because it makes the theft easier.

The heist in housing and mortgages

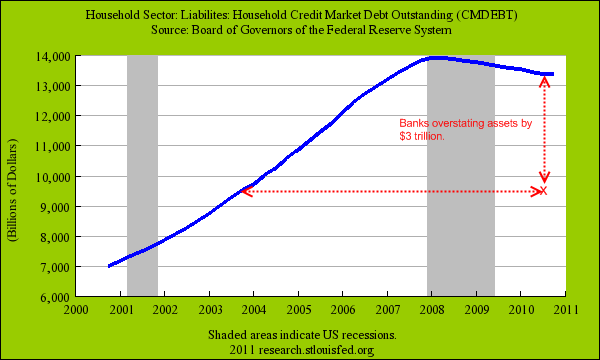

The above chart is critical in understanding that our current banking system is functionally insolvent. U.S. household carry roughly $13.5 trillion in debt. This is “money” to banks as it is an asset on their balance sheet. But with the double dip in housing, home prices have fallen by 31 percent from their peak. Mortgage debt is the biggest asset for banks running at over $10 trillion. Given that banks have yet to realize the mark to market realities and keep hiding bad assets in cover-up programs, banks are overstating assets by at least $3 trillion.

People wonder why banks are hoarding what is now comically called shadow inventory. In effect this is housing that should be sold and picked up by the banks but they refuse to do so. Why? First, examine the above chart again. Banks claim mortgage debt as assets and therefore look wealthier than they really are. This artificial wealth makes their balance sheets seem healthier and it frees them up to speculate on Wall Street. Banks refuse to process these homes because they would have to realize the actual value of that rat invested shack that they lent out $500,000 on. When they sell the property on the current market it may yield only $100,000 to $200,000 depending on what neighborhood it is in. Since the FDIC is broke and banks simply claim debt as money, debt that is now not being paid on for over 6 million homes and you can see how the dominoes begin to fall.

The entire banking edifice is sitting atop mountains of debt. Think about some really rough numbers here:

-$10+ trillion in mortgage debt-$1 trillion in student loan debt-$750+ billion in credit card debt

And billions of dollars in other debt including automobile loans. Current household debt is basically equivalent to U.S. annual GDP. In other words banks are creating money to boost households that don’t have the ability to purchase items without going into massive debt. Banks can pretend they are richer and households can buy more stuff that they cannot afford. That is the avarice of the system.

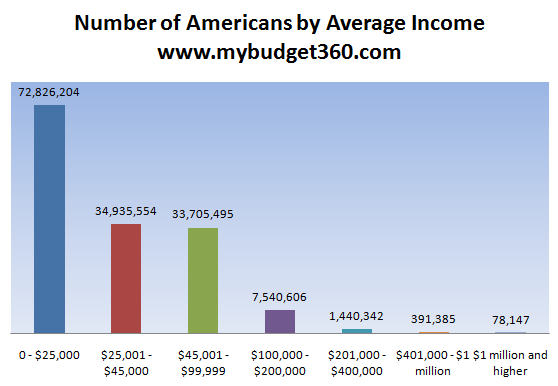

All of this is occurring with the average per capita income in the U.S. being $25,000. People have a really hard time believing this because they have been conditioned to believe in the all hat and no cattle model of money. Yet this is actual data:

Source: Social Security

Surely my neighbor with the new car is wealthy. Of course my friend that bought that big house is wealthy. Again, look at the first chart and think of the $13.5 trillion in household debt floating in the market and also the reality that 50 percent of Americans wouldn’t know where to get $2,000 for an emergency in the next 30 days if it came down to it. The entire banking system is hanging by a thread. Thomas Jefferson had a healthy dose of skepticism when it came to banking. He understood that those holding the debt held a control over those who were borrowing. And when banks don’t even have to have their own money and simply borrow from the Federal Reserve the system become rife with corruption and avarice and we are now seeing the consequences of this.

The mass pseudo-income delusion

Fact: The middle class has been disappearing for well over a decadeFact: Households have been losing wealth on a steady pace for over a decadeFact: New employment is coming from lower paying job sectorsFact: Banking profits are back to near record levels

So why are people in denial about the above statistics? Why is it the case that people simply deny that in reality, the middle class in America is disappearing because a large part of the funds is being funneled in propping up a banking system that is clearly not helping the economy? One of the main reasons I believe is the temporarily embarrassed millionaire syndrome. I think a lot of Americans vote against their own economic wellbeing because they envision themselves as making millions of dollars speculating on paper stocks and raiding the savings accounts of Americans. Ironically 99.9 percent will never even come close to this and the data reflects this hard fact. Yet the draw of hitting some sort of lottery is deeply rooted and banks exploit this to the detriment of our overall society. This isn’t the hard workers that build companies and make it big both financially and professionally. We are talking about the vampire like financial system that sucks out money by robbing it from the productive sectors.

Need we go on? Let us go on and keep pretending our banking system is solvent for the sake of banking profits.

No comments:

Post a Comment