Fed stays on track with bond buying, for nowWASHINGTON (Reuters) –

The Federal Reserve said on Wednesday the economy continues to recover but is still in need of support, offering no indication that it is planning to reduce its bond-buying stimulus at its next meeting in September.The central bank said after a two-day meeting that it would keep buying $85 billion in mortgage and Treasury securities per month in its effort to strengthen an economy that it said was still challenged by federal budget-tightening. It also pointed to a recent run up in mortgage rates.In a post-meeting statement, policymakers described economic activity as having expanded at a “modest” pace in the first half of the year. They had called the recovery “moderate” after their last meeting in June.In another departure, the Fed’s policy-setting committee signaled some concern about the low level of inflation.“The committee recognizes that inflation persistently below its 2 percent objective could pose risks to economic performance, but it anticipates that inflation will move back toward its objective over the medium term,” the Fed said.

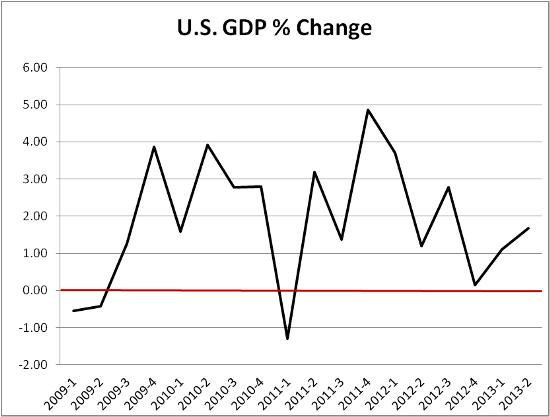

Why the cautious tone when just a few months ago “tapering” was a sure thing by yearend? Because this morning’s GDP report was, as usual, much weaker than it looked. Here’s a quick summary from Consumer Metrics Institute:

The new set of numbers for the 2nd quarter of 2013 in fact show weaker growth than previously reported numbers for the 1st quarter, but through the magic of historic revisions the headline (and the press release) can now tout quarter-to-quarter economic improvement — which should excite any markets that are blindly eager for good news, even if that good news is constructed from a revisionist history.Unfortunately, we can’t ignore a pattern of significant downward revisions to recent past data — suggesting a deeply rooted positive bias in the BEA’s “real time” reporting, including each of the prior four quarters. Even the number published just last month was revised materially downward by -0.64% (i.e., over a third of the previously reported growth has vanished).

Among CMI’s other points:

- The inflation number used to arrive at 2Q GDP is biased, and using a realistic deflator would yield a much lower growth number.

- A big part of 2Q growth came from rising government spending, which, in light of the debt ceiling debate, Detroit’s bankruptcy and Chicago’s recent downgrade probably isn’t a good bet going forward.

- Rising inventories, which move growth from the future into the present, will depress growth going forward. See American automobile glut: cars are piling up.

Even if we accept all the fluff in today’s numbers, a chart of recent GDP growth shows a hard stall, not a take-off. The Fed knows all this and has now completely walked back its talk of lowering its asset purchases. QE will go on until the market, not government, puts a stop to it.