Silver has long enjoyed its history, adored and coveted by all. Desired for it's lustrous appeal; used both for beautiful, and often ornate, jewelry and decoration but also as a safe and practical form of currency – thriving especially in times of economic woe when fiat currencies suffer.

Smart entrepreneurs and investors have been capitalizing on silver's potential for years. And their patience has truly paid off; this year especially amidst the wildy volatile markets and weakening currencies plaguing the global community.

Take a look at this Silver COMEX chart to see silver's staggering spikes since 1997.

Fun Facts About Silver

-Sterling silver (what pure silver becomes after being alloyed with other metals; typically copper) is harder than pure silver

-It has been used for hundreds of years as decoration AND currency

-It possesses high electrical conductivity

-Has a tendency to tarnish (which is why it is not used more-so for electrical purposes)

-Extractors remove silver from the earth through the process of chemical leeching or smelting

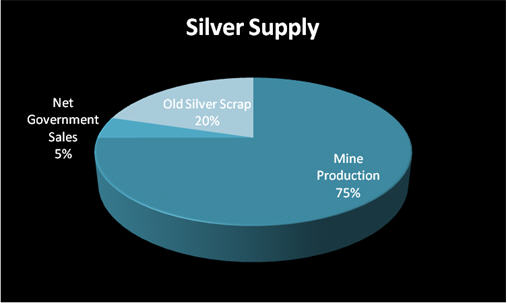

-Mining is the main way to supply silver products, although it can be recovered from scraps

-Even X-rays contain small amounts of silver!...Which may explain why many hospitals arenoticing higher rates of theft in their radiology departments as the price of silver spikes...

-Physical evidence suggests that silver was extracted even in ancient times. In the islands of the Aegean, there is evidence that extractors separted silver from lead as many as 6,000 years ago!

-After the Europeans discovered America, large deposits of silver were found in the New World

-Present day, America is home to many successful silver producing mines, primarily found in the western part of our nation.

The white pegs on the map (below) of the United States represent locations of silver mines.

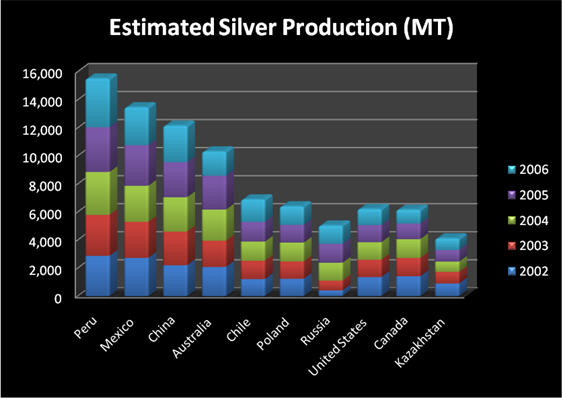

Globally, silver production is a key component to the wealth of many nations. See how production rates compare from country to country:

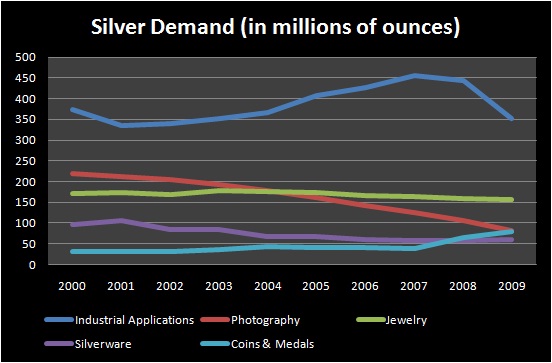

In terms of supply and demand, the most demand for silver revolves around industrial uses. With the explosion of growing industries to combat the jobs crisis, silver demand is set to soar beyond 2011...It's demand for use in photography and jewelry tails close behind. Silver's least amount of demand comes from its use as coins, medals, and silverware.

Comparatively, here's a breakdown of the silver supply:

Since the 1970s, the silver market has changed greatly.

Here's a bulleted, brief summary of the history of the silver market since that time:

-In the 70s, silver hovered around $5 per ounce. Just before the 80s, two brothers – Nelson Bunker Hunt and William Herbert Hunt – became knows as silver hoarders. “Bullion prices were rising on a mix of inflation and geopolitical tensions and silver rode high - up from just over $6 an ounce to nearly $35.”

-By January of 1980, silver spiked over $50 an ounce making it a year to remember for silver investors.

-In the summer of 1982, silver fell back down to prices familiar to the 1970s. Prices rebounded to just over $8 an ounce after Mexico said they would nationalize banks.

-Throughout that 1990s, silver fell even lower – all the way down to $3.40 an ounce.

-By February of 1998, infamous investor Warren Buffet and his company purchased 130 million ounces of silver. Prices peaked at $7.40 that February.

-From 2004 onward, silver futures prices climbed steadily and even dramatically at times. In 2006, silver was stable at about $10 per ounce. Two years later, the commodity markets gained more mainstream attention because of the stock market crash of '08 and silver prices more than doubled. And very recently, we've seen silver dancing around the $50 range in lieu of the fiscal messes facing the U.S. and Europe.

*Indented excerpts and data from InsideFutures.com.

PERTH, AUSTRALIA (Commodity Online):

PERTH, AUSTRALIA (Commodity Online):