This report lays out an investment thesis for gold and one for silver. Various factors lead me to conclude that gold is one investment that you can park for the next ten or twenty years, confident that it will perform well. My timing and logic for both entering and finally exiting gold (and silver) as investments are laid out in the full report. The punch line is this: Gold and silver are not (yet) in bubble territory, and large gains remain, especially if monetary, fiscal, and fundamental supply-and-demand trends remain in play.

Introduction

In 2001, as the painful end of the long stock bull market finally seeped into my consciousness, I began to grow quite concerned about my traditional stock and bond holdings. Other than a house with 27 years left on a 30 year mortgage, these holdings represented 100% of my investing portfolio. So I dug into the economic data to see what I could discover. What I found shocked me. It's all in the

Crash Course in both

video and

book form, so I won't go into that data here.

By 2002, I had investigated enough about our monetary, economic, and political systems that I decided that holding gold and silver would be a very good idea, poured 50% of my liquid net worth into precious metals, and sat back and watched.

Since then, my appreciation for and understanding of the role of gold as a monetary asset and silver as an indispensable industrial metal have deepened considerably.

Investing in gold and silver is still a good idea. Here's why.

Why own gold and silver?

The reasons to hold gold and silver, and I mean

physical gold and silver, are pretty straightforward. So let’s begin with the primary reasons to own gold.

- To protect against monetary recklessness

- As insulation against fiscal foolishness

- As insurance against the possibility of a major calamity in the banking/financial system

- For the embedded 'option value' that will pay out if and when gold is remonetized

By ‘

monetary recklessness,’ I mean the creation of money out of thin air and the application of more liquidity than the productive economy actually needs. The central banks of the world have been doing this for decades, not just since the onset of the great financial crisis. In gold terms, the supply of above-ground gold is growing at roughly 3% per year, while money supply has been growing at nearly three times that yearly rate since 1980.

Now this is admittedly an unfair view, because the economy has been growing, too, but money and credit growth have handily outpaced even the upwardly distorted GDP measurements by a wide margin. As the economy stagnates under this too-large debt load while the credit system continues to operate as if perpetual expansion were possible, look for all the resulting extra dollars to show up in prices of goods and services.

Real interest rates are deeply negative (meaning that the rate of inflation is higher than Treasury bond yields). This is a forced, manipulated outcome courtesy of central banks that are buying bonds with thin-air money. Historically, periods of negative real interest rates are nearly always associated with outsized returns for commodities, especially precious metals. If and when real interest rates turn positive, I will reconsider my holdings in gold and silver, but not until then. That is as close to an absolute requirement as I have in this business.

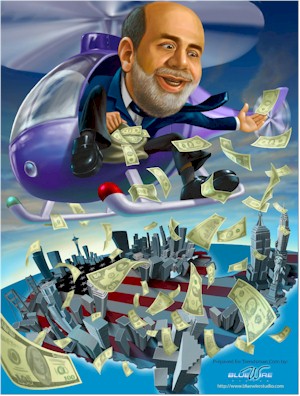

Monetary policies across the developed world remain as accommodating as they’ve ever been. Even Greenspan's 1% blow-out special in 2003 was not as steeply negative in real terms as what Bernanke has recently engineered. But it is the highly aggressive and ‘alternative’ use of the Federal Reserve balance sheet to prop up insolvent banks and to sop up extra Treasury debt that really has me worried. There seems to be no way to end these ever-expanding programs, and they seem to have become a permanent feature of the economic and financial landscape. In Europe, the equivalent would be the sovereign debt now found on the European Central Bank (ECB) balance sheet.

Federal deficits are seemingly out of control and are now stuck in the -$1.5 trillion range. Massive deficit spending has always been inflationary, and inflation is usually gold/silver friendly. Although not always, mind you, as the correlation is not strong, especially during mild inflation (less than 5%). Note, for example, that gold fell from its high in 1980 all the way to its low in 1998, an 18 year period with plenty of mild inflation along the way. Sooner or later I expect extraordinary budget deficits to translate into extraordinary inflation.

Reason #3,

insurance against a major calamity in the banking system, is an important part of my rationale for holding gold. I’m not referring to “paper gold” either, which includes the various tradable vehicles (like the "GLD" ETF) that you can buy like stocks through your broker. I’m talking about physical gold and silver because of their unusual ability to sit outside of the banking/monetary system and act as monetary assets.

Literally everything else financial, including your paper US money, is simultaneously somebody else’s liability, but gold and silver are not. They are simply, boringly, just assets. This is a highly desirable characteristic that is not easily replicated.

Should the banking system suffer a systemic breakdown, to which I ascribe a reasonably high probability of greater than 1-in-4 over the next 5 years, I expect banks to close for some period of time. Whether it's two weeks or six months is unimportant; no matter the length of time, I'd prefer to be holding gold than bank deposits.

During a banking holiday, your money will be frozen and left just sitting there, even as everything priced in money (especially imported items) rocket up in price. By the time your money is again available to you, you may find that a large portion of it has been looted by the effects of a collapsing currency. How do you avoid this? Easy; keep some ‘money’ out of the system to spend during an emergency. I always advocate three months of living expenses in cash, but you owe it to yourself to have gold and silver in your possession as well.

The final reason for holding gold,

because it may be remonetized, is actually a very big draw for me. While the probability of this coming to pass may be low, the rewards would be very high.

Here are some numbers: The total amount of 'official gold,' or that held by central banks around the world, is 30,684 tonnes, or 987 million troy ounces (MOz). In 2008 the total amount of money stock in the world was roughly $60 trillion.

If the world wanted 100% gold backing of all existing money, then the implied price for an ounce of gold is ($60T/987MOz) = $60,790 per troy ounce.

Clearly that's a silly number (or is it?), but even a 10% partial backing of money yields $6,000 per ounce. The point here is not to bandy about outlandish numbers, but merely to point out that unless a great deal of the world's money stock is destroyed somehow, or a lot more official gold is bought from the market and placed into official hands, backing even a fraction of the world's money supply by gold will result in a far higher number than today's ~$1,500/Oz.

The Difference Between Silver and Gold

Often people ask me if I hold

goldandsilver as if it were one word. I do own both, but for almost entirely different reasons. Gold, to me, is a monetary substance. It has money-like qualities and it has been used as money by diverse cultures throughout history. I expect that to continue.

There is a chance, growing by the week, that gold will be remonetized on the international stage due to a failure of the current all-fiat regime. If or when the fiat regime fails, there will have to be some form of replacement, and the only one that we know works for sure is a gold standard. Therefore, a renewed gold standard has the best chance of being the ‘new’ system selected during the next bout of difficulties.

Silver is an industrial metal with a host of enviable and irreplaceable attributes. It is the most conductive metal known, and therefore it is widely used in the electronics industry. It is used to plate critical bearings in jet engines and as an antimicrobial additive to everything from wall paints to clothing fibers. In nearly all of these uses, plus a thousand others, it is used in such vanishingly small quantities that it is hardly worth recovering at the end of the product life cycle -- and often isn’t.

Because of this dispersion effect, above-ground silver is actually at something of a historical low point. When silver was used primarily for monetary and ornamentation purposes, the amount of above-ground, refined silver grew with every passing year. After industrial uses cropped up, that trend reversed, and today there are perhaps 1 billion ounces above ground, when in 1980 there were roughly 4 billion ounces.

Because of this consumption dynamic, it's entirely possible that over the next twenty years not one single net new ounce of above ground silver will be added to inventories, while in contrast, a few billion ounces of gold will be added.

I hold gold as a monetary metal. I own silver because of its residual monetary qualities, but more importantly because I believe it will continue to be in demand for industrial uses for a very long time, and it will become a scarce and rare item.

Scarcity

If we cast our minds forward ten years and think about a world with oil costing 2x to maybe 8x more than today, we have to ask how many of our currently-operating gold and silver mines, or the base metal mines from which gold and silver are by-products, will still be in operation, and how many will close because their energy costs will have exceeded their marginal economic benefits.

After just 100 years of modern, machine-powered mining, nearly all of the good ores are gone. By the time you are reading stories like this next one, you should be thinking, 'Why are they going to all that trouble unless that's the best option left?'

South African Miners Dig Deeper to Extend Gold Veins' Life Spans

Feb 17, 2011

JOHANNESBURG—With few new gold strikes around the world that can be turned into profitable mines, South Africa's gold miners are planning to dig deeper than ever before to get access to rich veins.

The plans raise questions about how to safely and profitably mine several miles below the surface. Success would mean overcoming problems such as possible rock falls, flooding and ventilation challenges and designing technology to overcome the threats.

Mark Cutifani, chief executive officer of AngloGold Ashanti Ltd., has a picture in his office of himself at one of the deepest points in Africa, roughly 4,000 meters, or 13,200 feet, down in the company's Mponeng mine south of Johannesburg. Mr. Cutifani sees no reason why Mponeng, already the deepest mining complex in the world, shouldn't in time operate an additional 3,000-plus feet deeper.

"The most critical challenges for all of us in South Africa are depths and depletion of reserves," Mr. Cutifani said in an interview.

The above article is just a different version of the story that led to the Deepwater Horizon incident. By the time exceptional engineering challenges are being pondered to scrape a little deeper, it tells the alert observer everything they need to know about where we are in the depletion cycle. We are closer to the end than the beginning.

We are at a point in history where we can easily look forward and make the case for declining per-capita production of numerous important elements just on the basis of constantly falling ore purities, and gold and silver fit into that category rather handily. Depletion of reserves is a very real dynamic. It is not one that future generations will have to worry about; it is one with which people alive today will have to come to terms.

The issue of Peak Oil only exacerbates the reserve depletion dynamic by adding steadily rising energy input costs to mix. Should oil get to the point of actual scarcity, where we have to ration by something other than price, then we must ask where operating marginal mines fits into the priority list. Not very high, would be my guess.

Supply and Demand - Gold

Not surprisingly, the high prices for gold and silver have stimulated quite a bit of exploration and new mine production. With over a decade of steadily rising prices, there has been ample time to bring on new production. Which leads to a real surprise: In the case of gold, relatively little incremental mine production has occurred.

The analytical firm Standard Chartered has calculated a rather subdued 3.6% gold production growth over the next five years:

Most market commentary on gold centres on the direction of US dollar movements or inflation/deflation issues – we go beyond this to examine future mine supply, which we regard as an equally important driver. In our study of 375 global gold mines and projects, we note that after 10 years of a bull market, the gold mining industry has done little to bring on new supply. Our base-case scenario puts gold production growth at only 3.6% CAGR over the next five years.

(Source - Standard Chartered)

Of course, none of this is actually surprising to anyone who understands where we are in the depletion cycle, but it's probably quite a shock to many an economist. The quoted report goes on to calculate that existing projects just coming on-line need an average gold price of $1,400 to justify the capital costs, while greenfield, or brand-new, projects require a gold price of $2,000 an ounce.

This enormous increase in required gold prices to justify the investment is precisely the same dynamic that we are seeing with every other depleting resource: Energy costs run smack-dab into declining ore yields to produce an exponential increase in operating costs. And it's not as simple as the fuel that goes into the Caterpillar D-9s; it's the embodied energy in the steel and all the other energy-intensive mining components all along the entire supply chain.

Just as is the case with oil shales that always seem to need an oil price $10 higher than the current price to break even, the law of receding horizons (where rising input costs constantly place a resource just out of economic reach) will prevent many an interesting, but dilute, ore body from being developed. Given declining net energy, that's forever, as far as I am concerned.

The punch line of the Standard Chartered gold report is that they think $5,000 gold is a realistic target and go on to note the most important shift in gold accumulation of the past 30 years:

The limited new supply comes at a time when central banks have turned from being net sellers to significant net buyers of gold. The result, in our view, will be a gold market in deficit, even assuming flat growth in demand.

With the supply-demand balance so out of kilter, we see the gold price potentially going to US$5,000/oz.

(Source)

The emergence of central banks being net acquirers of gold is actually a pretty big deal. Over the past few decades, central banks have been actively reducing their gold holdings, preferring paper assets over the 'barbarous relic.' Famously, Canada and Switzerland vastly reduced their official gold holdings during this period, a decision that many citizens of those countries have openly and actively questioned.

The World Gold Council out of the UK is the primary firm that aggregates and reports on gold supply-and-demand statistics. Here's the most recent data on official (i.e., central bank) gold holdings:

(

Source)

Note that the 2009 data is lowered by slightly more than 450 tonnes in this chart to remove the one-time announcement by China that it had secretly acquired 454 tonnes over the prior six years, so this data may differ from other representations you might see. I thought it best to remove that blip from the data. Also, the data for 2011 is for the first four months only, so we might expect 2011 to be a record-setter if the current pace continues.

Overall, world supply and demand are a bit out of alignment right now, with supply increasing by 2% last year and non-official demand increasing by 10%:

The summary of the fundamental analysis is that with mine production seriously lagging, the price increases for gold, and increased central bank and investment demand, we have set the stage for some hefty price increases irrespective of any fiscal or monetary shenanigans.

However, once we put those back into the mix, I forecast a quite volatile but upwardly sloping price for gold over the coming years. Possibly a very steep upward slope at points.

Supply and Demand - Silver

Silver demand is growing by double-digit percentages, being led primarily by industrial uses and investment demand. The Silver Institute does a fine job of tracking and reporting on these matters.

First, demand:

Total fabrication demand grew by 12.8 percent to a 10-year high of 878.8 Moz in 2010; this surge was led by the industrial demand category. Last year, silver’s use in industrial applications grew by 20.7 percent to 487.4 Moz, nearly recovering all the recession-induced losses in 2009, and is now seeing pronounced advances in 2011. Jewelry posted a gain of 5.1 percent, the first substantial rise since 2003, primarily due to strong GDP gains in emerging markets and the industrialized world’s improving economic picture. Photography fell by 6.6 Moz, realizing its smallest loss in nine years, as medical centers deferred conversion to digital systems. Silverware demand fell to 50.3 Moz from 58.2 Moz in 2009, essentially due to lower demand in India.

(Source)

Now, supply:

Silver Production 2010

Silver mine production rose by 2.5 percent to 735.9 Moz in 2010 aided by new projects in Mexico and Argentina. Gains came from primary silver mines and as a by-product of lead/zinc mining activity, whereas silver volumes produced as a by-product of gold fell 4 percent last year.

Mexico eclipsed Peru as the world’s largest silver producing country in 2010, and Peru is followed by China, Australia and Chile. Global primary silver supply recorded a 5 percent increase to account for 30 percent of total mine production in 2010.

(Source)

Again, we are comparing double-digit demand increases against low single-digit supply increases. After a decade of rather dramatic price increases for silver, the alert observer should be asking exactly why this is the case.

In table form, we can clearly see that the silver balance for the world requires both dishoarding from government stockpiles and the recycling of scrap silver. That is, shortfalls from mining have to be made up from above-ground stocks:

(

Source)

There's only so long that such an imbalance can continue before the shortfalls require much higher prices to cool off demand.

One of the precise reasons that I originally invested quite heavily in silver is that I came to the conclusion that the price was far too low, artificially so, and that it would therefore be a great investment. So far, so good.

Given the above fundamentals, I project that prices for the precious metals will be many multiples higher - in today's dollar terms - by the end of the decade.

Source

Bernanke gave this speech soon after the collapse of the NASDAQ bubble, when deflation threatened the US for the first time since the 1930s. His ideas about how to prevent deflation are important if we are to understand his ideas about curing it. He began by stating, “I believe that the chance of significant deflation in the United States in the foreseeable future is extremely small …” He went on: “A particularly important protective factor in the current environment is the strength of our financial system: Despite the adverse shocks of the past year, our banking system remains healthy and well-regulated, and firm and household balance sheets are for the most part in good shape.”

Bernanke gave this speech soon after the collapse of the NASDAQ bubble, when deflation threatened the US for the first time since the 1930s. His ideas about how to prevent deflation are important if we are to understand his ideas about curing it. He began by stating, “I believe that the chance of significant deflation in the United States in the foreseeable future is extremely small …” He went on: “A particularly important protective factor in the current environment is the strength of our financial system: Despite the adverse shocks of the past year, our banking system remains healthy and well-regulated, and firm and household balance sheets are for the most part in good shape.”