One sure upshot of the quantitative easing money flooding the stock market will be further distortions, chaos and unpredictability that make the value-investing proposition difficult, if not impossible, according to Casey Research Chairman Doug Casey. On the eve of a sold-out Casey Research Summit in Boca Raton, Florida, Doug returns toThe Gold Report. In this exclusive interview, he warns, "Like it or not, you're going to be forced to be a speculator."

The Gold Report: When the average investor turns on the news, even on financial channels, they hear that the U.S. economy is in the best shape it's been in for three or four years. While the experts say the recovery is slower than anticipated, they expect its slow recovery will equate to a long, slow growth cycle similar to that after World War II. You have a contrary view.

Doug Casey: The only things that are doing well are the stock and bond markets. But the markets and the economy are totally different things – except, over a very long period of time, there's no necessary correlation between the economy doing well and the market doing well. My view is that the market is as high as it is right now – with the Dow over 12,000 – solely and entirely because the Federal Reserve has created trillions of dollars, as other central banks around the world have created trillions of their currency units. Those currency units have to go somewhere, and a lot of them have gone into the stock market. As a general rule, I don't believe in conspiracy theories, and I don't believe anything's big enough to manipulate the market successfully over a long period. At the same time, the government recognizes that most people conflate the Dow with the economy, so it is directing money toward the market to keep it up. Of course, the government wants to keep it up for other reasons – not just because it thinks the economy rests on the psychology of the people, which is complete nonsense. Psychology is just about the most ephemeral thing on which you could possibly base an economy. It can blow away like a pile of feathers in a hurricane.

TGR: So, you're saying we're confusing the market's performance with the economy's performance?

DC: Yes. The fact is that the economy itself is doing very badly. The numbers are phonied up. I spend a lot of time in Argentina. Anybody with any sense knows you can't believe the numbers coming out of the Argentinean Government Statistical Bureau, nor can you (any longer) believe the numbers that come out of Washington D.C. The inflation numbers consider only the things the government wants to look at and are artificially low. It's the same with the unemployment numbers. None of these things is believable.

TGR: Isn't the unemployment figure a lagging indicator of a rebounding economy?

DC: If you look at the way unemployment was computed until the early 1980s – something that John Williams from ShadowStats does – the numbers would indicate about 20% unemployment today. Besides, even while the population keeps rising, the number of people reported as actually working is level or even lower. Most indicators of the economic establishment, in my view, don't really make any sense. GDP, for instance, includes government spending – much of which amounts to paying some people to dig ditches during the day and other people to fill them in at night. So-called "defense" spending is almost totally wasted capital. The practice of economics today is pathetic and laughable.

TGR: So, the economy is not rebounding?

DC: No. My take on this is that we entered what I call the "Greater Depression" in 2007. And now, because the government has printed up trillions of dollars in the last couple of years, we're in the eye of the hurricane. We've only gone through the leading edge of the storm. People think this will just be another cyclical recovery like all the others since WWII. But it's not. It's going to wind up with the currency being destroyed. It's going to be a disaster… a worldwide catastrophe.

TGR: You indicated that the government is using these mass infusions of made-up money to prop up the stock market due to the psychological factor – that people will think the economy's doing well because the market is doing well. However, we hear that a lot of that money has been caught up in the banks. Would you comment on that?

DC: As I said, that money has to go somewhere. The banks have been borrowing from the Fed at something like 0.5% and investing it in government securities at 2%, 3% or 4%, depending on the maturity. So, much of that money has been a direct gift to the banks; and they're basically making an arbitrage spread of 2%–4%. So, yes, that's happening with some of the money. Still, it doesn't all just sit in these Treasury securities. A great deal of it, inevitably, goes into the stock market.

TGR: You also said that psychology isn't the only reason the government wants to see the stock market go higher.

DC: Right. Pension funds have a great deal of their assets in stocks. Certainly, many funds run by government entities, such as the state and city employee pension funds, are approaching bankruptcy despite the fact that the Fed has driven interest rates to historic lows, artificially pumping up both stocks and bonds. And, I might add, keeping property prices higher than they would be otherwise. When interest rates rise eventually – and they will go up a lot – it'll be something to behold in the markets.

TGR: You mentioned John Williams who's in your speaker lineup for the Casey Research Summit, The Next Few Years. Another of your speakers is Stansberry Associates Founder Porter Stansberry, who's been making two points about the devaluation of the U.S. dollar. One point he makes in hisThe End of America video concerns the quantitative easing (QE) you mentioned –those trillions of dollars. But Porter also anticipates the U.S. government announcing a devaluation of the currency similar to what England did in 1970. Do you see that type of scenario occurring, as well?

DC: When the U.S. government last officially devalued the dollar in August 1971, it had been fixed to $35 per ounce to gold. In other words, before that, any foreign government could take the dollars it owned and trade them in at the Treasury for gold. Nixon devalued the dollar by raising it to $38/oz., and then to $42/oz. It was completely academic, anyway, because he wouldn't redeem gold from the Treasury at any price. But because the dollar isn't fixed against anything now, the government can't officially devalue it. It's a floating market. The government's going to devalue the dollar by printing more of the damn things and letting them lose value gradually – actually the loss will no longer be gradual, but quite fast from here on out. But it's not going to do so formally by re-fixing the dollar against some other currency or against gold. I'm not sure Porter's phrasing it in the best way, but he's quite correct in his conclusion and his prescriptions as to how to profit from it. At this point, the dollar is nothing more than a floating abstraction, an IOU nothing on the part of a manifestly bankrupt government.

TGR: Another abstraction is the fact that the Treasury says the money it is printing has a multiplier effect when it gets into the U.S. economy, so it can pull those dollars back when the time comes. Is that a viable alternative to offset the devaluation caused by printing more money?

DC: You have to look first at the immediate and direct effects of what the government's doing, and then at the delayed and indirect effects. And sure, just as it's injecting all this money into the economy – mainly by the Fed buying U.S. government bonds – theoretically, it can take it out of the economy by doing the opposite. But I just don't see that happening.

TGR: Why not?

DC: One of the reasons is that the U.S. government, itself, is running annual trillion-dollar deficits as far as the eye can see. I think those deficits will go higher – not lower. So, where's that money going to come from? Where will it get trillions of dollars to fund the U.S. government every year? China isn't going to buy this paper, and Japan will be selling its U.S. government paper because, if nothing else, it'll need to buy things to redo the northeast part of the country. Nobody else is going to buy that trillion-dollar deficit either, so it'll have to be the Federal Reserve. In fact, the Fed will have to buy much more and, therefore, create more money. That's what happens.

TGR: This currency crisis isn't unique to the U.S. You just brought up Japan. And aren't all the European countries doing the same thing?

DC: The U.S., unfortunately, is not unique. This is going to be a worldwide catastrophe. It's been a disaster for every country that's done this in the past – Zimbabwe, Germany, Hungary, Yugoslavia and countries in South America – but those were within only those particular countries. In most of those cases, people never trusted their governments; so, they had significant assets outside the country in a form other than the local currency. The problem now is that the U.S. dollar is the world's reserve currency and all of these central banks own USDs as the backing for their own currencies. All these other countries will wind up finding that they don't have any assets after all. That's going to happen all over the world.

TGR: With countries around the globe facing the same issue, should anyone hold currencies?

DC: No. Sure, you need local currency to go to the store and buy a loaf of bread. But for liquid assets you're trying to save, it's insane to own currencies at this point because they're all going to reach their intrinsic value. I've been recommending for many years that people buy gold and own gold for their savings – serious capital they want to put aside in liquid form. With gold now over $1,500/oz. and silver at $48, people who followed that advice have made a lot of money. That's the good news. The bad news is that very few people have done so. Newbies to the game are paying $1,500/oz. for gold. It's going higher, but it's no longer the bargain that it was. The important thing to remember, though, is that gold is the only financial asset that's not simultaneously someone else's liability. That's why it's always been used as money and why it's likely to be reinstituted as money.

TGR: From your viewpoint, how does a person with any wealth preserve it during this tumultuous period other than by investing in gold?

DC: Frankly, I don't know. I own beef and dairy cattle, which are a good place to be; but that's a business, and it's not practical for most people. I think it boils down to gold.

TGR: But what investments should they be looking at these days?

DC: There really aren't investments anymore. With trillions of newly created currency units floating around the world, things will become very chaotic and unpredictable shortly. It's very hard to invest using any kind of Graham-and-Dodd methodology when things are that chaotic. Whether you like it or not, you're going to be forced to be a speculator in the years to come. A speculator is somebody who tries to capitalize on politically caused distortions in the marketplace. There wouldn't be many speculators, or many of those distortions in the marketplace, if we lived in a free-market society. But we don't.

TGR: So, speculation will supplant value investing?

DC: Well, investing is best defined as allocating capital in a way that it reliably produces more capital. The government is going to make that quite hard in the years to come with much higher taxes, much higher inflation and draconian regulations. You will actually be forced to speculate. That's a pity, from the point of view of the economy as a whole. But I kind of like it, in a way. Few people know how to be speculators, so I should be able to make a huge amount of money in the next few years. Unfortunately, it'll be at a time when most people are losing their shirts. But I don't make the rules. I just play the game.

TGR: As you look over the next year or two with your speculator hat on, what sectors do you expect to experience the most distortion and, therefore, offer the most opportunity for the speculator?

DC: One sure bet is the collapse of the U.S. dollar. Always bet against the USD and you'll be on the winning side of the trade. A very direct way to make that bet is by shorting long-term U.S. government bonds because, eventually, interest rates will go to the moon, which means bond prices will collapse. You can also look at the precious metals because, at some point, when people panic into them, their price curves will go parabolic. Mining stocks are likely to draw a lot of money, so they could go wild as they have many times over the last 40 years.

TGR: Your summit has presentations scheduled on silver, gold, currencies, Asia, real estate, agriculture and even more. What do you expect to be the major takeaway this time?

DC: What we're facing now is something of absolutely historic importance – the biggest thing that's gone on in the world since the Industrial Revolution. Many things will be completely overturned in the years to come. What's happening now in the Arab world, with all of these corrupt kleptocracies being challenged and overthrown, is just the beginning. We haven't seen the end of this in any of these countries – Tunisia, Egypt, Syria, Algeria. Of course, Saudi Arabia will be the big one. Everything's going to be overturned. And all these stooges that the U.S. government has been supporting for years could very well lose their heads. It's going to be the most tumultuous decade for hundreds of years, bigger than what happened in the 1930s and 1940s.

TGR: Any last things you'd like to tell our readers?

DC: Yeah. Hold on to your hats. You're in for a wild ride. At the Casey Research Summit in Boca Raton, 35 of the most renowned economists, investment and natural-resource pros convene to talk about the U.S. and global economy, the fate of the dollar, the threat of rampant inflation… and the best ways to make it through that “wild ride” in the next few years. Among them are big names like ShadowStats’ John Williams, investment legend James Rickards, financial author Chris Whalen, and “Rich Dad” advisor Mike Maloney.

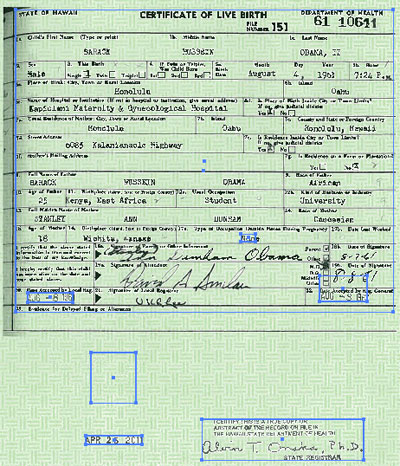

Upon first inspection, the document appears to be a photocopy taken from state records and printed on official green paper. However, when the government released PDF is taken into the image editing program Adobe Illustrator, we discover a number of separate elements that reveal the document is not a single scan on paper, as one might surmise. Elements are place in layers or editing boxes over the scan and green textured paper, which is to say the least unusual.

Upon first inspection, the document appears to be a photocopy taken from state records and printed on official green paper. However, when the government released PDF is taken into the image editing program Adobe Illustrator, we discover a number of separate elements that reveal the document is not a single scan on paper, as one might surmise. Elements are place in layers or editing boxes over the scan and green textured paper, which is to say the least unusual.