In the years since the derivatives disaster, there has been no end to the absurd and ludicrous propaganda coming out of mainstream financial outlets and as the situation in markets becomes worse, the propaganda will only increase.

In the years since the derivatives disaster, there has been no end to the absurd and ludicrous propaganda coming out of mainstream financial outlets and as the situation in markets becomes worse, the propaganda will only increase.

This might seem counter-intuitive to many. You would think that the more obvious the economic collapse becomes, the more alternative analysts will be vindicated and the more awake and aware the average person will be. Not necessarily…

In fact, the mainstream spin machine is going into high speed the more negative data is exposed and absorbed into the markets. If you know your history, then you know that this is a common tactic by the establishment elite to string the public along with false hopes so that they do not prepare or take alternative measures while the system crumbles around their ears. At the onset of the Great Depression the same strategies were used. Consider if you’ve heard similar quotes to these in the mainstream news over the past couple months:

John Maynard Keynes in 1927: “We will not have any more crashes in our time.”

H.H. Simmons, president of the New York Stock Exchange, Jan. 12, 1928: “I cannot help but raise a dissenting voice to statements that we are living in a fool’s paradise, and that prosperity in this country must necessarily diminish and recede in the near future.”

Irving Fisher, leading U.S. economist, The New York Times, Sept. 5, 1929:“There may be a recession in stock prices, but not anything in the nature of a crash.” And on 17, 1929: “Stock prices have reached what looks like a permanently high plateau. I do not feel there will be soon if ever a 50 or 60 point break from present levels, such as (bears) have predicted. I expect to see the stock market a good deal higher within a few months.”

W. McNeel, market analyst, as quoted in the New York Herald Tribune, Oct. 30, 1929: “This is the time to buy stocks. This is the time to recall the words of the late J. P. Morgan… that any man who is bearish on America will go broke. Within a few days there is likely to be a bear panic rather than a bull panic. Many of the low prices as a result of this hysterical selling are not likely to be reached again in many years.”

Harvard Economic Society, Nov. 10, 1929: “… a serious depression seems improbable; [we expect] recovery of business next spring, with further improvement in the fall.”

Here is the issue – as I have ALWAYS said, economic collapse is not a singular event, it is a process. The global economy has been in the process of collapse since 2008 and it never left that path. Those who were ignorant took government statistics at face value and the manipulated bull market as legitimate and refused to acknowledge the fundamentals. Now, with markets recently suffering one of the greatest freefalls since the 2008/2009 crash, they are witnessing the folly of their assumptions, but that does not mean they will accept them or apologize for them outright. If there is one lesson I have learned well during my time in the Liberty Movement, it is to never underestimate the power of normalcy bias.

There were plenty of “up days” in the markets during the Great Depression, and this kept the false dream of a quick recovery alive for a large percentage of the American population for many years. Expect numerous “stunning stock reversals” as the collapse of our era progresses, but always remember that it is the overall TREND that matters far more than any one positive or negative trading day (unless you open down 1000 points as we did on Monday), and even more important than the trends are the economic fundamentals.

The establishment has made every effort to hide the fundamentals from the public through far reaching misrepresentations of economic stats. However, the days of effective disinformation in terms of the financial system are coming to an end. As investors and the general public begin to absorb the reality that the global economy is indeed witnessing a vast crisis scenario and acknowledges real numbers over fraudulent numbers, the only recourse of central bankers and the governments they control is to convince the public that the crisis they are witnessing is not really a crisis. That is to say, the establishment will attempt to marginalize the collapse signals they can no longer hide as if such signals are of “minimal” importance.

Just as occurred during the onset of the Great Depression, the lies will be legion the closer we come to zero hour. Here are some of the lies you will likely hear as the collapse accelerates…

The Crisis Was Caused By Chinese Contagion

The hypocrisy inherent in this lie is truly astounding, to say the least, considering it is now being uttered by the same mainstream dirtbags who only months ago were claiming that China’s financial turmoil and stock market upset were inconsequential and would have “little to no effect” on Western markets.

“Something else that doesn’t matter much is the Chinese equity meltdown—again. China may be big and powerful, but it lacks a retail base and fund managers experienced in price variations, never mind a true rout…”

“Doom-and-gloom types have been saying for a long time that we will get a stock market rout when the Fed finally does move to raise rates. But as we wrote last week, history doesn’t bear out the thesis, not that you can really count on history when the sample size is one or two data points…”

Yes, that is a bit embarrassing. One or two data points? There have been many central bank interventions in history. When has ANY central bank or any government ever used stimulus to manipulate markets through fiat infusion and zero interest fueled stock buybacks or given government the ability to monetize its own debt, and actually been successful in the endeavor? When has addicting markets to stimulus like a heroin dealer ever led to “recovery”? When has this kind of behavior ever NOT created massive fiscal bubbles, a steady degradation of the host society, or outright calamity?

Suddenly, according to the MSM, China’s economy does affect us. Not only that, but China is to blame for all the ills of the globally interdependent economic structure. And, the mere mention that the Fed might delay the end of near zero interest rates in September by a Federal Reserve stooge recently sent markets up 600 points after a week-long bloodbath; meaning, the potential for any interest rate increase no mater how small also has wider implications for markets.

The truth is, the crash in global stocks which will undoubtedly continue over the next several months despite any delays on ZIRP by the Fed is a product of universal decay in fiscal infrastructure. Nearly every single nation on this planet, every sovereign economy, has allowed central and international banks to poison every aspect of their respective systems with debt and manipulation. This is not a “contagion” problem, it is a systemic problem to every economy across the world.

China’s crash matters not because it is causing all other economies to crash. It matters because China is the largest importer/exporter in the world and it is a litmus test for the financial health of every other country. If China is failing, it means we are not consuming, and if we are not consuming, then we must be broke. China’s crash portends our own far worse economic conditions. THAT is why western markets have been crumbling along with China’s despite the assumptions of the mainstream.

China’s Rate Cuts Will Stop The Crash

No they won’t. China has cut rates five times since last November and this has done nothing to stem the tide of their market collapse. I’m not sure why anyone would think that a new rate cut would accomplish anything besides perhaps a brief respite from the continuing avalanche.

It’s Not A Crash, It’s Just The End Of A “Market Cycle”

This is the most ignorant non-explanation I think I have ever heard. There is no such thing as a “market cycle” when your markets are supported partially or fully by fiat manipulation. Our market is in no way a free market, thus, it cannot behave like a free market, and thus, it is a stunted market with no identifiable cycles.

Swings in markets of up to 5%-6% to the downside or upside (sometimes both in a single day) are not part of a normal cycle. They are a sign of cancerous volatility that comes from an economy on the brink of disaster.

The last few years have been seemingly endless market bliss in which any idiot day trader could not go wrong as long as he “bought the dip” while Fed monetary intervention stayed the course. This is also not normal, even in the so-called “new normal”. Yes, the current equities turmoil is an inevitable result of manipulated markets, false statistics, and misplaced hopes, but it is indeed a tangible crash in the making. It is in no way an example of a predictable and non-threatening “market cycle”, and the fact that mainstream talking heads and the people who parrot them had absolutely no clue it was coming is only further evidence of this.

The Fed Will Never Raise Rates

Don’t count on it. Public statements by globalist entities like the IMF on China, for example, have argued that their current crisis is merely part of the “new normal”; a future in which stagnant growth and reduced living standards is the way things are supposed to be. I expect the Fed will use the same exact argument to support the end of zero interest rates in the U.S., claiming that the decline of American wealth and living standards is a natural part of the new economic world order we are entering.

That’s right, mark my words, one day soon the Fed, the IMF, the BIS and others will attempt to convince the American people that the erosion of the economy and the loss of world reserve status is actually a “good thing”. They will claim that a strong dollar is the cause of all our economic pain and that a loss in value is necessary. In the meantime they will, of course, downplay the tragedies that will result as the shift toward dollar devaluation smashes down on the heads of the populace.

A rate hike may not occur in September. In fact, as I predicted in my last article, the Fed is already hinting at a delay in order to boost markets, or at least slow down the current carnage to a more manageable level. But, they WILL raise rates in the near term, likely before the end of this year after a few high tension meetings in which the financial world will sit anxiously waiting for the word on high. Why would they raise rates? Some people just don’t seem to grasp the fact that the job of the Federal Reserve is to destroy the American economic system, not protect it. Once you understand this dynamic then everything the central bank does makes perfect sense.

A rate increase will occur exactly because that is what is needed to further destabilize U.S. market psychology to make way for the “great economic reset” that the IMF and Christine Lagarde are so fond of promoting. Beyond this, many people seem to be forgetting that ZIRP is still operating, yet, volatility is trending negative anyway. Remember when everyone was ready to put on their ‘Dow 20,000’ hat, certain in the omnipotence of central bank stimulus and QE infinity? Yeah…clearly that was a pipe dream.

ZIRP has run it’s course. It is no longer feeding the markets as it once did and the fundamentals are too obvious to deny.

The globalists at the Bank for International Settlements in spring openly deemed the existence of low interest rate policies a potential trigger for crisis. Their statements correlate with the BIS tendency to “predict” terrible market events they helped to create while at the same time misrepresenting the reasons behind them.

The point is, ZIRP has done the job it was meant to do. There is no longer any reason for the Fed to leave it in place.

Get Ready For QE4

Again, don’t count on it. Or at the very least, don’t expect renewed QE to have any lasting effect on the market if it is initiated.

There is truly no point to the launch of a fourth QE program, but do expect that the Fed will plant the possibility in the media every once in a while to mislead investors. First, the Fed knows that it would be an open admission that the last three QE’s were an utter failure, and while their job is to dismantle the U.S. economy, I don’t think they are looking to take immediate blame for the whole mess. QE4 would be as much a disaster as the ECB’s last stimulus program was in Europe, not to mention the past several stimulus actions by the PBOC in China. I’ll say it one more time – fiat stimulus has a shelf life, and that shelf life is over for the entire globe. The days of artificially supported markets are nearly done and they are never coming back again.

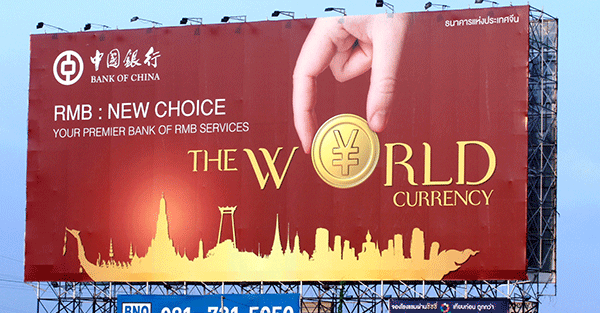

I see little advantage for the Fed to bring QE4 into the picture. If the goal is to derail the dollar, that action is already well underway as the IMF carefully sets the stage for the Yuan to enter the SDR global currency basket next year, threatening the dollar’s world reserve status. China also continues to dump hundreds of billions in U.S. treasuries inevitably leading to a rush to a dump of treasuries by other nations. The dollar is a dead currency walking, and the Fed won’t even have to print Weimar Germany-style in order to kill it.

It’s Not As Bad As It Seems

Yes, it is exactly as bad as it seems if not worse. When the Dow can open 1000 points down on a Monday and China can lose all of its gains for 2015 in the span of a few weeks despite institutionalized stimulus measures lasting years, then something is very wrong. This is not a “hiccup”. This is not a correction which has already hit bottom. This is only the beginning of the end.

Stocks are not a predictive indicator. They do not follow positive or negative fundamentals. Stocks do not crash before or during the development of an ailing economy. Stocks crash after the economy has already gone comatose. Stocks crash when the system is no longer salvageable. Since 2008, nothing in the global financial structure has been salvaged and now the central banking edifice is either unable or unwilling (I believe both) to supply the tools to allow us even to pretend that it can be salvaged. We’re going to feel the hurt now, all while the establishment tells us the whole thing is in our heads.

Source

China took another step to boost the yuan’s global usage, saying it will start direct trading with the Swiss franc, as the nation pushes its case for reserve-currency status at the International Monetary Fund.

China took another step to boost the yuan’s global usage, saying it will start direct trading with the Swiss franc, as the nation pushes its case for reserve-currency status at the International Monetary Fund.