Ron Paul answers questions on The Fed, ISIS fear-mongers, catches the terror opportunists red handed, and even throws in some economic wisdom. Don't miss it!

...and an opportunity to be part of the greatest wealth transfer in the history of mankind.

29 Nov 2015

Ron Paul Answeres Questions on The Fed, ISIS and more.

Ron Paul answers questions on The Fed, ISIS fear-mongers, catches the terror opportunists red handed, and even throws in some economic wisdom. Don't miss it!

25 Nov 2015

Brazil in Horrific Recession: Sincerely, US Dollar.

The 7th largest economy on the entire planet, Brazil, has been gripped by a horrifying recession, as has much of the rest of South America. But it isn’t just South America that is experiencing a very serious economic downturn. We have just learned that Japan (the third largest economy in the world) has lapsed into recession. So has Canada. So has Russia. The dominoes are starting to fall, and it looks like the global economic crisis that has already started is going to accelerate as we head into the end of the year. At this point, global trade is already down about 8.4 percent for the year, and last week the Baltic Dry Shipping Index plummeted to a brand new all-time record low. Unfortunately for all of us, the Federal Reserve is about to do something that will make this global economic slowdown even worse.

The 7th largest economy on the entire planet, Brazil, has been gripped by a horrifying recession, as has much of the rest of South America. But it isn’t just South America that is experiencing a very serious economic downturn. We have just learned that Japan (the third largest economy in the world) has lapsed into recession. So has Canada. So has Russia. The dominoes are starting to fall, and it looks like the global economic crisis that has already started is going to accelerate as we head into the end of the year. At this point, global trade is already down about 8.4 percent for the year, and last week the Baltic Dry Shipping Index plummeted to a brand new all-time record low. Unfortunately for all of us, the Federal Reserve is about to do something that will make this global economic slowdown even worse. Throughout 2015, the U.S. dollar has been getting stronger. That sounds like good news, but the truth is that it is not. When the last financial crisis ended, emerging markets went on a debt binge unlike anything we have ever seen before. But much of that debt was denominated in U.S. dollars, and now this is creating a massive problem. As the U.S. dollar has risen, the prices that many of these emerging markets are getting for the commodities that they export have been declining. Meanwhile, it is taking much more of their own local currencies to pay back and service all of the debts that they have accumulated. Similar conditions contributed to the Latin American debt crisis of the 1980s, the Asian currency crisis of the 1990s and the global financial crisis of 2008 and 2009.

Throughout 2015, the U.S. dollar has been getting stronger. That sounds like good news, but the truth is that it is not. When the last financial crisis ended, emerging markets went on a debt binge unlike anything we have ever seen before. But much of that debt was denominated in U.S. dollars, and now this is creating a massive problem. As the U.S. dollar has risen, the prices that many of these emerging markets are getting for the commodities that they export have been declining. Meanwhile, it is taking much more of their own local currencies to pay back and service all of the debts that they have accumulated. Similar conditions contributed to the Latin American debt crisis of the 1980s, the Asian currency crisis of the 1990s and the global financial crisis of 2008 and 2009.

Many Americans may be wondering when “the next economic crisis” will arrive, but nobody in Brazil is asking that question. Thanks to the rising U.S. dollar, Brazil has already plunged into a very deep recession…

As Brazilian president Dilma Rousseff combats a slumping economy and corruption accusations, the country’s inflation surged above 10 percent while unemployment jumped to 7.9 percent, according to the latest official data. The dour state of affairs has Barclays forecasting a 4 percent economic contraction this year, followed by 3.3 percent shrinkage next year, the investment bank said in a research note last week.The political and economic turmoil has recently driven the real, Brazil’s currency, to multiyear lows, a factor helping to stoke price pressures.

And as I mentioned above, Brazil is far from alone. This is something that is happening all over the planet, and the process appears to be accelerating. One of the places where this often first shows up is in the trade numbers. The following comes from an article that was just posted by Zero Hedge…

“This market is looking like a disaster and the rates are a reflection of that,” warns one of the world’s largest shipbrokers, but while The Baltic Dry Freight Index gets all the headlines –having collapsed to all-time record lows this week – it is the spefics below that headline that are truly terrifying. At a time of typical seasonal strength for freight and thus global trade around the world, Reuters reports that spot rates for transporting containers from Asia to Northern Europe have crashed a stunning 70% in the last 3 weeks alone. This almost unprecedented divergence from seasonality has only occurred at this scale once before… 2008! “It is looking scary for the market and it doesn’t look like there is going to be any life in the market in the near term.”

Many “experts” seem mystified by all of this, but the explanation is very simple.

For years, global economic growth was fueled by cheap U.S. dollars. But since the end of QE, the U.S. dollar has been surging, and according to Bloomberg it just hit a 12 year high…

The dollar traded near a seven-month high against the euro before the release of minutes of the Federal Reserve’s October meeting, when policy makers signaled the potential for an interest-rate increase this year.A trade-weighted gauge of the greenback is at the highest in 12 years as Fed Chair Janet Yellen and other policy makers have made numerous pronouncements in the past month that it may be appropriate to boost rates from near zero at its Dec. 15-16 gathering. The probability the central bank will act next month has risen to 66 percent from 50 percent odds at the end of October.

But even though the wonks at the Federal Reserve supposedly know the damage that a strong dollar is already doing to the global economy, they seem poised to make things even worse by raising interest rates in December…

Most Federal Reserve policymakers agreed last month that the economy “could well” be strong enough in December to withstand the Fed’s first Interest rate hike in nearly a decade, according to minutes of its meeting Oct. 27-28.The officials said global troubles had eased and a delay could increase market uncertainty and undermine confidence in the economy.The meeting summary provides the clearest evidence yet that a majority of Fed policymakers are leaning toward raising the central bank’s benchmark rate next month, assuming the economy continues to progress.

Considering the tremendous amount of damage that has already been done to the global economy, this is one of the stupidest things that they could possibly do.

But it looks like they are going to do it anyway.

It has been said that those that refuse to learn from history are doomed to repeat it.

And right now so many of the exact same patterns that we saw just before the great financial crisis of 2008 are playing out once again right in front of our eyes.

A lot of people out there seem to assume that once we got past the September/October time frame that we were officially out of “the danger zone”.

But that is not true at all.

The truth is that we have already entered a new global economic downturn that is rapidly accelerating, and the financial shaking that we witnessed in August was just a foreshock of what is coming next.

Let us hope that common sense prevails and the Fed chooses not to raise interest rates at their next meeting.

Because if they do, it will just make the global crisis that is now emerging much, much worse.

Original Source

Original Source

Negative interest rates to hit the US

It started in 1921.

World War I was over. The Treaty of Versailles had been signed two years before.

And Germany, the biggest loser from the war, had been stuck with both the blame and the bill.

Germany’s war debt– which it owed not only for its own war-related expenses, but also for reparations to the victors– was devastating.

They didn’t have the money, so they started printing it.

Not surprisingly, the German mark began to sink. It started slowly at first, but by 1921 hyperinflation had taken hold until prices soared by thousands of percent.

One of my favorite stories from this period, was of the elderly man who went to the police to report a robbery. Thieves had stolen a wheelbarrow of money.

One of my favorite stories from this period, was of the elderly man who went to the police to report a robbery. Thieves had stolen a wheelbarrow of money.

It was common at the time to use wheelbarrows to transport the huge sums of cash that were required to buy even the most simple things like bread and milk.

When the police asked him how much was in the wheelbarrow, the man corrected them saying that the thieves had only stolen the wheelbarrow, and had left the cash behind.

Undoubtedly the entire society was upturned by this hyperinflation. But as history shows, in any situation, there are always winners and losers.

Pensioners and people who responsibly saved their money were wiped out; whereas people who had borrowed to invest in real assets did extremely well.

Owners of residential real estate suffered under government imposed rent controls, whereas owners of farmland thrived.

For people who saw the decline of the mark coming and bet against it, generational fortunes were made in a matter of years.

In the case of Germany in the 1920s, few people probably expected that hyperinflation would ensue.

Even the president of their central bank, Dr. Rudolf Havenstein, firmly believed that there was zero connection between price levels and the amount of money he printed.

Yet it happened, and those who saw the warning signs and took steps to reduce their risk did very well.

Today there is no shortage of risk in the financial system either.

Negative interest rates are becoming more and more common in developed nations and they’re on their way to America as well.

Every time there’s a recession, the government cuts interest rates by easily half a percent to a percent.

So with interest rates already at zero, when the next recession comes (and it absolutely will), you can expect interest rates to go negative.

Meanwhile, Western banking systems are highly illiquid, meaning that they have very low cash equivalents as a percentage of customer deposits.

This isn’t some wild conspiracy theory. You can see it for yourself in the financial statements banks publish every quarter.

Solvency in many Western banking systems is also highly questionable, with many loaded up on the debts of their bankrupt governments.

Banks also play clever accounting games to hide the true nature of their capital inadequacy.

We live in a world where questionably solvent, highly illiquid banks are backed by under capitalized insurance funds like the FDIC, which in turn are backed by insolvent governments and borderline insolvent central banks.

This is hardly a risk-free proposition.

Yet your reward for taking the risk of holding your money in a precarious banking system is a rate of return that is substantially lower than the official rate of inflation.

And in many cases, it’s even negative. Rates are already negative in Europe, and again, it’s coming to the US. Either way, you’re guaranteed to lose money.

Risk is a funny thing. The reason why it’s so frequently misdiagnosed is because there’s often a huge discrepancy between the actual risk and the perceived risk.

You can see that very clearly with banking.

People perceive the risk in their banking system to be zero.

And while I’m not suggesting that there is some imminent collapse, the data clearly indicate that the actual risk is significant.

Given the meager and even negative interest rates, the risk-reward ratio just doesn’t add up.

To address different types of risk in the system, I see four main solutions:

One is to hold physical cash, enabling you to effectively be your own private banker and giving you an excellent short-term hedge against risks in your domestic banking system.

However, this comes with additional physical security risks and potential political risks such as civil asset forfeiture or cash bans.

Another option is to establish a foreign bank account in a jurisdiction where banks are liquid, well-capitalized, and backed by a government with minimal debt.

It’s hard to imagine you’d be worse off for having a portion of your savings in a safe, stable, debt-free jurisdiction.

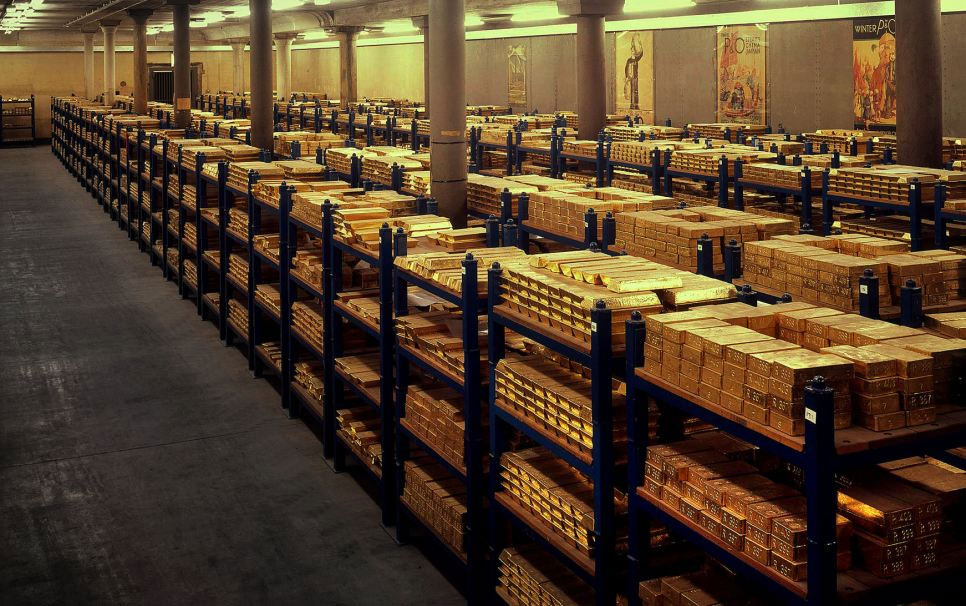

Then there’s gold and silver, which are excellent long-term hedges, not only against risks in the banking system, but the monetary system at large.

Last but not least, it is 2015, and I would be negligent if I didn’t mention cryptocurrency as a viable option to hedge risk in both the banking and financial system.

Original Source, and Podcast can be found here

Original Source, and Podcast can be found here

13 Nov 2015

Central Banks Snapping Up Gold at Near-Record Pace

Central banks and other institutions boosted gold purchases to the second-highest level on record in the quarter to September as countries including China and Russia sought to diversify their foreign-exchange reserves.

Net purchases were 175 metric tons, nearing the record 179.5 tons in the same quarter a year earlier, and up from 127.9 tons in the preceding three-month period, the World Gold Council said in a report on Thursday. Still, over the first nine months central banks’ net purchases dropped 6.7 percent to 425.8 tons, according to the council.

Russia, China and Kazakhstan are among states buying bullion this year, helping to support prices that are headed for a third annual loss. Central banks will probably remain net buyers as emerging-market institutions continue to boost their allocation, while developed countries are reluctant to sell, Barclays Plc said in an Oct. 21 report.

“Diversification of reserve assets, especially among developing nations, remains the primary motivation for this increase in official gold reserves, as many recognize that the economic and geopolitical outlook continues to look far from certain,” the council said.

In July, the People’s Bank of China ended six years of mystery surrounding its reserves, revealing a 57 percent jump in gold assets since 2009 to about 1,658 tons. Asia’s largest economy, which rivals India as the biggest gold consumer, has been increasing holdings monthly since then and may have added a further 14 tons in October.

We’re in the Early Stages of Largest Debt Default in US History

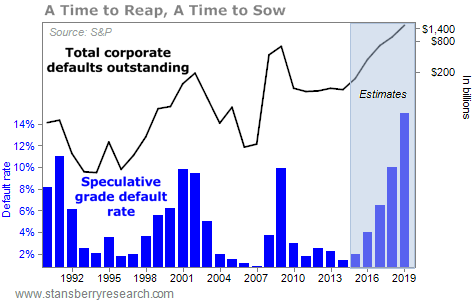

We know roughly the size and scope of the coming default wave because we know the history of the U.S. corporate debt market. As the sizes of corporate bond deals have grown over time, each wave of defaults has led to bigger and bigger defaults.

Here's the pattern.

Default rates on "speculative" bonds are normally less than 5%. That means less than 5% of noninvestment-grade, U.S. corporate debt defaults in a year. But when the rate breaks above that threshold, it goes through a three- to four-year period of rising, peaking, and then normalizing defaults. This is the normal credit cycle. It's part of a healthy capitalistic economy, where entrepreneurs have access to capital and frequently go bankrupt.

If you'll look back through recent years, you can see this cycle clearly...

In 1990, default rates jumped from around 4% to more than 8%. The next year (1991), default rates peaked at more than 11%. Then default rates began to decline, reaching 6% in 1992. By 1993, the crisis was over and default rates normalized at 2.5%. Around $50 billion in corporate debt went into default during this cycle of distress.

Six years later, in 1999, the distress cycle began to crank up again. Default rates hit 5.5% that year and jumped again in 2000 and 2001 – hitting almost 8.7%. They began to fall in late 2002, reaching normal levels by 2003.

Interestingly, the amount of capital involved in this cycle was much, much larger: Almost $500 billion became embroiled in default. The growth in risky lending was powered by the innovation of the credit default swap (CDS) market. It allowed far riskier loans to be financed. As a result, the size of the bad corporate debts had grown by 10 times in only one credit cycle.

The most recent cycle is the one you're most familiar with – the mortgage crisis.

Six years after default rates normalized in 2003, they suddenly spiked up to almost 10% in 2009. But thanks to a massive and unprecedented government intervention, featuring trillions of dollars in credit protection, default rates immediately returned to normal in 2010. As a result, only about $1 trillion of corporate debt went into default during this cycle.

You should know, however, that the regular market-clearing process of rising, peaking, and normalizing default rates did not occur in the last cycle. A massive, unprecedented intervention in the markets by the Federal Reserve stopped the default cycle in its tracks. As a result, trillions of dollars in risky debt did not enter default and were not written off.

Over the last six years, this "victory" against bankruptcy and the credit cycle has led many government leaders and their economic apologists (like Paul Krugman) to declare victory. What they won't admit is that the lack of a debt-clearing cycle has resulted in a weak recovery, and an economy that's still heavily burdened by unsustainable debts.

What happens next should be obvious to everyone: The big debt-clearing cycle that was "paused" in 2009 will make the next debt-clearing cycle much, much larger – by far the biggest we've ever seen. When will that happen? Six years after default rates last returned to normal. In other words... right now.

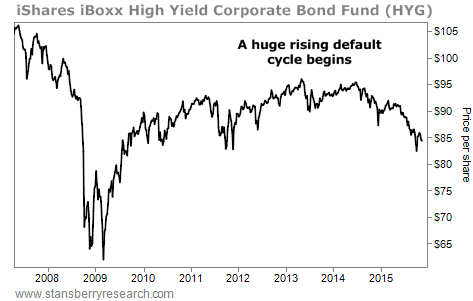

The chart above shows the iShares iBoxx High Yield Corporate Bond Fund (HYG), which invests in a broad range of speculative corporate bonds. As the risk of defaults in this market grows, these bonds will begin to trade at much lower prices, causing their yields to increase. Currently, the yield on this basket of bonds is less than 6%. Look for yields to increase to well above 10% before default rates begin to normalize. That implies losses of 30%-40% are still to come in these bonds.

Over the last year, HYG is down about 9%. A negative return is unusual for the corporate-bond market, especially when there isn't a recession.

So far this year, nearly 300 U.S. corporations have seen their bonds downgraded. That's the most downgrades per year since the financial crisis of 2008-2009. The year isn't over yet. Neither are the downgrades. More worrisome, the 12-month default rate on high-yield corporate debt has doubled this year. This suggests we are well into the next major debt-default cycle.

And it will almost surely be a "super" cycle – meaning it will last longer and cause far more losses than most people expect.

Here's another way to time the next debt-clearing cycle.

At the end of 2014, only 1.42% of speculative corporate debt had gone into default for the year – near a record low. The only better year for speculative corporate debt in recent history was the top of the mortgage-debt boom in 2006. As you know, two years later, disaster struck. A new low for defaults in 2014 points to 2016 as the year when corporate debt will begin a new default cycle.

Martin Fridson, the world's foremost expert on the high-yield bond market, says his "base-case scenario" is for between $1.6 trillion and $2 trillion in defaults in high-yield bonds over the next three to four years. We believe default rates will be a lot worse, simply because the market has grown so much, thanks to things like CDS credit protection and the securitization of subprime consumer lending.

Now, before you panic... here's an idea you'll see us repeat again and again over the next three to four years.

What's happening – rising default rates, rising interest rates on corporate debt, and falling stock prices – doesn't need to be a crisis for you, personally.

Instead, this period could be the best opportunity that you will ever get to buy great assets and great businesses at great prices.

You don't need to think of this coming crisis as the "end." Instead, think of what's happening as a badly needed reckoning. It's simply a housecleaning. Nothing much will change. The best assets and best businesses will still be here after the storm. The only real difference will be who owns them.

What's coming is the greatest transfer of wealth in history. Over the next few years, trillions of dollars' worth of businesses, land, resources, and intellectual property are going to exchange hands – legally, but unwillingly.

Investors who have been frugal and cautious will be rewarded. Investors who have been greedy and foolish will be punished.

In tomorrow's final segment, I'll show you the absolute best way to take advantage of this upcoming opportunity.

Source

12 Nov 2015

Greatest (Legal) Wealth Transfer in History

I put marketplace in quotes, because Jet isn't really a marketplace at all. It's a facsimile of a marketplace. It purports to compete with Amazon – offering everything imaginable for sale. But unlike Amazon, Jet doesn't really have much to sell... or really any products at all. What it does have, though, is lower prices than other online retailers.

Currently, Jet lists 4.5 million products for sale on its website. But it owns almost none of them. Instead, Jet copies the products and descriptions of other online retailers. It then offers the same products on its website at a lower price.

When a Jet customer orders a product, a Jet employee goes to the actual online retailer's website and orders the product. It's then shipped to the Jet customer's home.

While Jet is losing money – a lot of money – on every sale, it plans to make up for the losses by dealing in huge volume. No, I'm not kidding. The company's business model is to build a huge client list by taking these losses and then, eventually, turn a profit by charging its users a $50 membership fee. A recentWall Street Journal test of the website revealed the company lost more than $200 on the sales of 12 items.

Currently, Jet is valued at $600 million by the geniuses at Goldman Sachs, Google Ventures, and Alibaba.

I doubt Jet would be possible were it not for essentially unlimited amounts of nearly free capital it could borrow, courtesy of the world's investment banks. That much seems obvious...

For the past six years, the Federal Reserve (the central bank of the United States) and its major counterparts around the world have conducted an enormous monetary experiment.

As my research team and I have shown our subscribers again and again... not since World War II has the U.S. created so much paper money. Other nations, like Japan, have created even more "monetary stimulus." All around the world, central banks have been creating money out of thin air and buying trillionsworth of government bonds and other "safe" forms of fixed-income securities, like mortgages.

This has driven down the cost of capital drastically in all developed economies. Academic and popular economists, like Paul Krugman, have endorsed these massive experiments. Politicians clearly believe in the "medicine" of central banks' massive currency printing and bond buying.

On the other hand, we've been fierce critics of these actions. Call us old-fashioned, but we believe in an older, more conservative "brand" of economics. In our experience, the creation of wealth always begins with the act of saving capital.

Interest rates, in our humble opinion, should be set by actual demand for capital. This demand ought to create interest rates that encourage thrift, economy, and savings. These interest rates would act as a brake on reckless speculation, forcing entrepreneurs and large businesses to consider what new projects are worthwhile.

But... what happens when capital is not created by the crucible of careful saving... and what happens when entrepreneurs pay essentially no cost to gamble? You get farces like Jet.

While the Federal Reserve's policies might spur economic activity, we do not see how lower interest rates necessarily create bona fide economic growth or actual wealth. By messing around with the most important price in all of capitalism (the price of capital itself), the Fed deliberately short-circuited the flow of information between consumers and producers and between borrowers and savers. Change the price system and you'll change behavior, because you're changing the information about incentives that people receive. And that rarely works out in the long run.

The Fed's policies have created several obvious bubbles in the financial markets...

One is in student lending. U.S. students have borrowed $1 trillion for college. Most of these loans were used to purchase vastly overpriced "online" educations of highly dubious value. Consider that in 2000 – just 15 years ago – the largest debt-funded college in the U.S. was New York University, a highly credible, long-standing institution that serves smart and ambitious students. At the time, former and current NYU students had $2.2 billion in student loans outstanding.

Today, the leading debt-funded college in the U.S. is the University of Phoenix, where $36 billion (yes, that number is real) has been lent to current and former students, almost all of whom received an online education.

Eight out of the 10 largest debt-funded universities are online schools. I'd estimate the debts used to fund these educations make up around 80% of all outstanding student loans. These debts will never be repaid. And the default tidal wave is starting right now.

Another bubble is in the oil and gas sector... Nearly all the growth in the U.S. high-yield bond market over the last decade is related to oil and gas exploration and production. Since 2010, more than $500 billion worth of new corporate debt was raised for U.S. onshore oil and gas producers. It's this capital that financed the oil boom – which is responsible for all the net job creation in the U.S. since 2009.

These debts cannot be repaid with oil prices at less than $60. And yet they're all coming due between 2016 and 2020.

As these debts go bad, even major oil companies will see their bonds downgraded and their dividends cut. For the banks, insurance companies, private-equity funds, and pension funds that provided this initial capital, there's a tremendous amount of pain ahead.

However... while the end of these bubbles could be painful for many people. It will be a tremendous opportunity for those who know what's coming and are prepared for it. You can be among them...

Investors who are patient and liquid will have an opportunity to buy exceptional assets at great bargains. Over the next two days, I'm going to show you how to be on the right side of what will be the greatest legal transfer of wealth in history.

Source

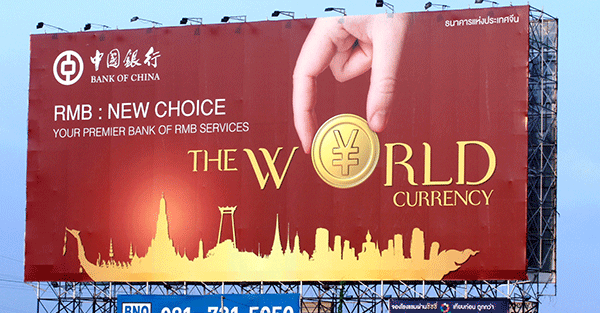

IMF to include CHINA (RMB) to Reserve currency this month?

Foreign asset managers are preparing to increase their exposure to yuan-denominated bonds, as the International Monetary Fund (IMF) looks likely this month to approve the inclusion of China's "redback" into its currency basket.

A decision by the IMF to add the currency, also known as the renminbi (RMB), to its $US280 billion ($A396.77 billion) basket of reserves would prompt central banks to follow suit, and fund managers say they, too, would make similar adjustments to their portfolios.

"The endorsement from the IMF raises the RMB's profile as an international reserve currency. We think many official investors will start to allocate to RMB assets," AXA Investment Managers said in a report.

Analysts forecast the IMF would give the yuan an initial weighting of around 14 per cent in the basket, which goes by the official title Special Drawing Rights (SDR), bringing about $US40 billion direct inflows in the next few years.

"Most central banks we've spoken to are supportive of the inclusion and are preparing for it. Several central banks are considering their first allocation and some considering increasing their existing ones," said Jukka Pihlman, head of central banks and sovereign wealth funds at Standard Chartered.

But central bank holdings would be the tip of the iceberg.

"That will trigger a lot of FX reserve managers to rebalance," said Stephen Chang, head of Asian fixed income at JP Morgan Asset Management.

"Global investors are certainly under-invested in Chinese bonds as they just started from pretty much zero," he added.

Together with other reserve managers and investors, a re-allocation annually of about one per cent of global FX reserves outside of China to yuan assets is expected in the short term.

AXA estimates total inflows to be around $US600 billion over the next five years. Fund managers and analysts say the vast bulk of the flow will target fixed-income products, especially high-grade bonds issued by the Chinese government and policy banks, which offer high returns at low risk.

"We are progressively increasing our exposure to yuan bonds, and we are more interested in onshore government bonds compared to (offshore) 'dim sum' bonds," said Bryan Collins, a portfolio manager at Fidelity Worldwide Investment. Foreign participation in China's $US7 trillion onshore bond market is a meagre two per cent at present, and Beijing is keen to broaden the sources of funding as the economy slows.

Bankers say that what the government has done to meet the technical criteria to get included in the SDR should in itself lead to an increase in foreign holdings of yuan assets.

China has scrapped quota limits for foreign central banks and sovereign wealth funds to buy bonds in its interbank market and is planning to extend yuan trading hours to cover the European trading session to attract more investors beyond Asia.

As more investors start to trade yuan bonds, improving market liquidity, that will further boost the appeal, said Sanjiv Shah, Chief Investment Officer at Sun Global Investments in London.

"It will make it easier for us to invest and will definitely lead to an increase of our investment in yuan bonds," said Shah, whose firm has assets under management of around $US500 million, of which about $US12 million is invested in offshore yuan bonds.

Source

Energy Market firms warn they may default at any minute

The last 3 days have seen the biggest surge in US energy credit risk since December 2014, blasting back above 1000bps. This should not be a total surprise since underlying oil prices continue to languish in "not cash-flow positive" territory for many shale producers, but, as Bloomberg reports, the industry is bracing for a wave of failures as investors that were stung by bets on an improving market earlier this year try to stay away from the sector. "It’s been eerily silent," in energy credit markets, warns one bond manager, "no one is putting up new capital here."

The market is starting to reprice dramatically for a surge in defaults...

Eleven months of depressed oil prices are threatening to topple more companies in the energy industry. As Bloomberg details,

Four firms owing a combined $4.8 billion warned this week that they may be at the brink, with Penn Virginia Corp., Paragon Offshore Plc, Magnum Hunter Resources Corp. and Emerald Oil Inc. saying their auditors have expressed doubts that they can continue as going concerns. Falling oil prices are squeezing access to credit, they said. And everyone from Morgan Stanley to Goldman Sachs Group Inc. is predicting that energy prices won’t rebound anytime soon.The industry is bracing for a wave of failures as investors that were stung by bets on an improving market earlier this year try to stay away from the sector. Barclays Plc analysts say that will cause the default rate among speculative-grade companies to double in the next year. Marathon Asset Management is predicting default rates among high-yield energy companies will balloon to as high as 25 percent cumulatively in the next two to three years if oil remains below $60 a barrel.“No one is putting up new capital here,” said Bruce Richards, co-founder of Marathon, which manages $12.5 billion of assets. “It’s been eerily silent in the whole high-yield energy sector, including oil, gas, services and coal.”That’s partly because investors who plowed about $14 billion into high-yield energy bonds sold in the past six months are sitting on about $2 billion of losses, according to data compiled by Bloomberg.And the energy sector accounts for more than a quarter of high-yield bonds that are trading at distressed levels, according to data compiled by Bloomberg.

Barclays said in a Nov. 6 research note that the market is anticipating “a near-term wave of defaults” among energy companies. Those can’t be avoided unless commodity prices make “a very large” and “unexpected” resurgence.

“Everybody’s liquidity is worse than it was at this time last year,” said Jason Mudrick, founder of Mudrick Capital Management. “It’s a much more dire situation than it was 12 months ago.”

11 Nov 2015

China to devalue the Yuan?

China’s economic model of export-led and investment-driven growth is in crisis. With no one left to export more to every year, China now finds itself with extraordinary excess capacity across every industry. Product prices are falling, companies are unprofitable and bank loans are going bad. Any further investment will just worsen the situation.

Therefore, China is buying much less raw materials from the rest of the world. As a result, commodity prices have collapsed. Last month China’s imports were 20% less than during the same month last year. So, China is no longer a driver of global growth.

In fact, it is a very significant brake on global growth.

For that reason, many of the emerging market economies around the world have suffered a very sharp economic slowdown or even gone into recession. Many emerging market currencies have dropped substantially in line with the economic growth prospects of the emerging markets.

As many of these countries have borrowed heavily from abroad in recent years, often borrowing U.S. dollars, there is now a growing chance that they will not be able to repay those loans. Many creditors are attempting to withdraw their money from the emerging markets before the debt defaults begin.

The resulting capital outflows are compounding the problems those countries now face by making credit more expensive. All of these problems combined have thrown the global economy into a new recession that seems likely to become considerably worse before it gets better.

The dollar is the principal international reserve currency for one reason: the United States runs massive trade deficits with the rest of the world every year. That means that the rest of the world accumulates hundreds of billions of dollars every year. These they must invest in U.S. dollar-denominated assets, like U.S. government bonds.

The yuan is not an important international reserve currency because China does not have a massive trade deficit. Instead, it has a massive trade surplus every year. For that reason, other countries don’t own a lot of yuan. If China began to run a huge trade deficit with the rest of the world, then other countries would have a lot of yuan and they would be forced to buy yuan-denominated debt instruments.

Then the yuan would be an important reserve currency. But running a large trade deficit would cause tens of millions of Chinese factory worker to lose their jobs, leading to social instability. For this reason, the yuan is unlikely to become an important reserve currency within the foreseeable future — if ever.END Pull Quote Right

China’s economy is now under severe strain. Chinese policymakers would like to devalue the yuan against the dollar to boost China’s exports and economic growth. But China’s trade surplus with the United States was $340 billion last year. That means that, in the absence of intervention by the Chinese central bank, the yuan would appreciate against the dollar, not depreciate.

The value of the yuan relative to the dollar is something that is negotiated between the U.S. and Chinese governments on an ongoing basis. The U.S. government would like the yuan to continue appreciating against the dollar so that China’s trade surplus with the U.S. would stop expanding. The U.S. government certainly does not want the yuan to be devalued.

Not only would that further weaken the competitiveness of U.S. exporters relative to Chinese exporters, it would also export deflation to the United States since the U.S. buys $500 billion worth of goods from China every year. Any yuan devaluation would cause the price of those imports to fall and that would cause the U.S. price level to fall.

China, on the other hand, does not want the dollar to strengthen any further relative to the euro and the yen. That’s because the yuan is closely tied to the U.S. dollar, so when the dollar strengthens against the euro and the yen, so does the yuan. A stronger yuan hurts Chinese exports to Europe and Japan. Therefore, China does not want the Fed to increase interest rates since higher U.S. interest rates would cause the dollar and the yuan to appreciate against other currencies.

If the Fed does increase U.S. interest rates, China may devalue the yuan vs. the dollar so that the yuan does not appreciate against other currencies. One theory suggests that the small yuan devaluation in August was a warning to the Fed not to hike rates or else China would devalue.

A large devaluation of the yuan would be a terrible blow to the Fed because it would push down U.S. inflation (perhaps into negative territory), making it much more difficult for the Fed to reach its 2% inflation target.

So in my assessment, an interest rate hike by the Fed would increase the chance of a yuan devaluation. This “threat” may prevent the Fed from hiking interest rates any time soon.

However, there is still a possibility that China will devalue the yuan further even if the Fed does not hike. If China’s economy continues to deteriorate, Chinese policymakers may resort to currency devaluation as an emergency measure to prevent a serious economic contraction.

|

If China does devalue, the rest of the world would suffer. Commodity prices would fall further. Emerging market economies and their currencies would weaken further, increasing the chances of a new EM debt crisis. Corporate profits would be hit and global stock markets would sell off.

I expect the Fed to launch a fourth round of Quantitative Easing to keep the United States from falling back into recession.

Since 2008, credit growth has been too weak to drive economic growth in the United States. So the Fed has been driving economic growth by printing money and pushing up asset prices to create a wealth effect that spurs consumption and economic expansion.

After QE 1 and QE 2 ended, US asset prices fell and the U.S. started to go back into recession. Each time, the Fed launched another round of QE to prevent that from happening. I believe the same pattern will be repeated now that QE 3 has ended. The U.S. economy is already weakening very visibly.

I don’t think the Fed will launch QE 4 because it thinks it will be “the right solution for the emerging global economic situation.” I think the Fed will launch QE 4 because it is afraid that the U.S. economy will fall back into a very serious recession if it does not.

Having said that, I do believe that QE 4 will benefit emerging market economies in the same way that the first three rounds of Quantitative Easing did.

Another policy option would be for the United States to run a much larger budget deficit to provide fiscal stimulus to the US and global economy. That, however, will not happen before the 2016 U.S. presidential elections at the earliest, and probably not even after the elections.

Another policy option would be to do nothing. That’s the option policymakers picked in 1930. The result then was a global great depression. If policymakers choose to do nothing now, there is likely to be another global great depression.

The United States has been the driver of global economic growth since World War II. It is no longer growing enough to continue driving the global economy, but there is no other country that can take its place. In order to take over as a new driver of global growth, a country would have to run an even larger trade deficit than the U.S. does. That won’t be possible.

What could Japan have done to accelerate Japanese economic growth in 1990? After the great Japanese bubble economy had taken shape, I really don’t think there was anything Japan could have done to accelerate growth there. China is now in the same place Japan was in 1990. There is a huge economic bubble in China. I don’t see what they can do to “accelerate economic growth going forward.”

They will have a hard enough time just to prevent the bubble from collapsing into a serious depression. It will require very large budget deficits, a great deal of skill and a lot of good luck for China to even achieve 3% annual growth over the next 10 years.

All the government policies since 2008 (trillions of dollars of deficit spending, trillions of dollars of fiat money creation, 0% interest rates, etc.) have prevented a new global great depression thus far.

But now, since the end of QE 3, the policy stimulus is no longer adequate to keep the global bubble inflated. It is now starting to deflate. Our choice now is between more stimulus and a devastating new global depression that could very possibly destroy the world as we know it.

Source

Source

10 Nov 2015

Global Economic Trade Collapse

If you have been watching for the next major global economic downturn, you can now stop waiting, because it has officially arrived. Never before in history has global trade collapsed this dramatically outside of a major worldwide recession. And this makes perfect sense – when global economic activity is increasing there is more demand for goods and services around the world, and when global economic activity is decreasing there is less demand for goods and services around the world. So far this year, global trade is down about 8.4 percent, and over the past 30 days the Baltic Dry Index has been absolutely plummeting. A month ago it was sitting at a reading of 809, but now it has fallen all the way to 628. However, it is when you look at the trade numbers for specific countries that the numbers become particularly startling.

If you have been watching for the next major global economic downturn, you can now stop waiting, because it has officially arrived. Never before in history has global trade collapsed this dramatically outside of a major worldwide recession. And this makes perfect sense – when global economic activity is increasing there is more demand for goods and services around the world, and when global economic activity is decreasing there is less demand for goods and services around the world. So far this year, global trade is down about 8.4 percent, and over the past 30 days the Baltic Dry Index has been absolutely plummeting. A month ago it was sitting at a reading of 809, but now it has fallen all the way to 628. However, it is when you look at the trade numbers for specific countries that the numbers become particularly startling.

Just within the last few days, new trade numbers have come out of China. China accounts for approximately one-fifth of all global factory exports, and for many years Chinese export growth has helped fuel the overall global economy.

But now Chinese exports are falling. In October, Chinese exports were down 6.9 percent compared to a year ago. That follows a decline of 3.7 percent in September.

The numbers for Chinese imports are even worse. Chinese imports in October were down 18.8 percent compared to a year ago after falling 20.4 percent in September. China’s growing middle class was supposed to help lead a global economic recovery, but that simply is not happening.

The following chart from Zero Hedge shows just how dramatic these latest numbers are compared to what we are accustomed to witnessing. As you can see, the only time Chinese trade numbers have been this bad for this long was during the major global recession of 2008 and 2009…

Other numbers confirm the magnitude of the economic slowdown in China. I have mentioned the ongoing plunge of the China Containerized Freight Index previously, but now it has just hit a brand new record low…

The weakness in China’s economy and its exports to the rest of the world are showing up in the weekly China Containerized Freight Index (CCFI): On Friday, it dropped to the worst level ever.The index, operated by the Shanghai Shipping Exchange, tracks how much it costs, based on contractual and spot-market rates, to ship containers from China to 14 major destinations around the world. Unlike a lot of official data from China, the index is an unvarnished reflection of a relentless reality.It has been cascading lower since February and has since dropped 31%. At 742 currently, it’s down 26% from its inception in 1998 when it was set at 1,000.

Here are some more deeply disturbing global trade numbers that come from my previous article entitled “18 Numbers That Scream That A Crippling Global Recession Has Arrived“…

–Demand for Chinese steel is down 8.9 percent compared to a year ago.

–China’s rail freight volume is down 10.1 percent compared to last year.

–In October, South Korean exports were down 15.8 percent from a year ago.

–According to the Dutch government index, a year ago global trade in primary commodities was sitting at a reading of 150 but now it has fallen all the way down to 114. What this means is that less commodities are being traded around the world, and that is a very clear sign that global economic activity is really slowing down.

Additionally, German export orders were down about 18 percent in September, and U.S. exports are down about 10 percent for the year so far.

>

Clearly something very big is happening, and it is affecting the entire planet. The CEO of the largest shipping company in the world believes that the explanation for what is taking place is fairly simple…

In fact, according to Maersk CEO, Nils Smedegaard Andersen, the reason why companies that are reliant on global trade, such as his, are flailing is simple: global growth is substantially worse than the official numbers and forecasts. To wit: “The world’s economy is growing at a slower pace than the International Monetary Fund and other large forecasters are predicting.”Quoted by Bloomberg, Andersen says that “we believe that global growth is slowing down,” he said in a phone interview. “Trade is currently significantly weaker than it normally would be under the growth forecasts we see.“

Global financial markets can run, but they can’t hide from these horrifying trade numbers forever.

One of the big things that is contributing to this new global economic slowdown is the unwinding of the U.S. dollar carry trade. A recent piece from Phoenix Capital Research explained the U.S. dollar carry trade pretty well…

When the Fed cut interest rates to zero in 2008, it flooded the system with US Dollars. The US Dollar is the reserve currency of the world. NO matter what country you’re in (with few exceptions) you can borrow in US Dollars.And if you can borrow in US Dollars at 0.25%… and put that money into anything yielding more… you could make a killing.A hedge fund in Hong Kong could borrow $100 million, pay just $250,000 in interest and plow that money into Brazilian Reals which yielded 11%… locking in a $9.75 million return.This was the strictly financial side of things. On the economics side, Governments both sovereign and local borrowed in US Dollars around the globe to fund various infrastructure and municipal projects.Simply put, the US Government was practically giving money away and the world took notice, borrowing Dollars at a record pace. Today, the global carry trade (meaning money borrowed in US Dollars and invested in other assets) stands at over $9 TRILLION (larger than the economy of France and Brazil combined).

But now the U.S. dollar carry trade is starting to unwind because the U.S. dollar has been doing very well lately. As the U.S. dollar has surged against other global currencies in 2015, this has put a tremendous amount of stress on emerging markets around the world. All of a sudden oil, other commodities and stock markets in nations such as Brazil began to crash. Meanwhile, those that had taken out loans denominated in U.S. dollars were finding that it was taking far more of their own local currencies to service and repay those loans. This financial crunch in emerging markets is going to take years to fully play out, and it is going to take a tremendous toll on global markets.

Of course we have seen this happen before. A surging dollar helped cause the Latin American debt crisis of the 1980s, the Asian financial crisis of the 1990s andthe major global recession of 2008 and 2009.

If you thought that the financial shaking that happened in late August was bad, the truth is that it was nothing compared to what is now heading our way.

Subscribe to:

Posts (Atom)