...and an opportunity to be part of the greatest wealth transfer in the history of mankind.

15 Jul 2011

Silver Investor Mentality Shifts

We are going to see a huge shift in silver investor mentality. (By the looks of today’s action it could be today.) Silver buyers will no longer be “nerdy”guys talking about Austrian Economics or “momentum monkeys”trying to make a quick buck trading metals. It will be wide eyed panic buying as people wake up to the fact they everything they have ever worked for is being destroyed by the massive money creation from the world’s central banks. Once people see that the only answer the bankers have is to print more money and that the only answer the politicians have is to spend more money, they will see that there is no safe place on earth to store their wealth other than real tangible assets. And of course the best real tangible asset is silver. (Read the Silver Bullet and the Silver Shield.)

I predicted that silver, at one point, would not be available at any dollar price. You can throw away all of your $50, $100, $500 price targets, because society would finally see the enormity of the fraud in the silver market. Once this fraud exposed,no person on earth would dare let go of their silver for fiat paper money. Sure a couple of ounces might be available at the local shop, but the vast majority of the silver markets will be as barren as the shelves of a post collapse Soviet Union grocery store. This global mentality shift in asset values will lead to a paradigm shift where the world no longer wants debt money. Only real money will do in the new paradigm.

1. Physical investors who have been stacking physical silver will be stunned by the sudden appreciation. It will be akin to someone winning the lottery. They will shocked at the enormity of their new found wealth which occurs at the same time the economy becomes an absolute horror show. A shift in the perception of wealth will confirm that they are holding something truly precious. The years of being told they are crazy for buying silver will finally give way to, “you were right.”After the shock wears off, these newly minted kings will seek to make the most off of this once in a life time opportunity. These men were astute enough to buy silver when everyone said they were nuts, they are certainly now not going to give up what they have for some dirty dollars that they did not want years ago. They will wait for something much, much better. They will not see immediately many opportunities to invest their new wealth in, because the final throes of the debt based economy will be horrific. No one will invest when it is not certain what will happen to humanity. They will have no choice but to wait until the act plays out and the music stops.

2. Long term paper investors who have been sitting on the sidelines, will rush to buy silver this time around. I cannot tell you how many people I know that are literally dragging their feet buying silver. ( You know who you are.) They understand why to buy, but it is just so hard for them to pull the trigger. Unfortunately,it will not be until much higher prices that they will finally pull the trigger. When they do buy, they will be joining a fast and furious rush as those fence sitters finally panic for the exits. They will see that Europe’s debt problem, is the world’s debt problem. We cannot solve debt with more debt. They will see a world awash in more debt/money. They will see that no paper asset is safe with the amount of money printing that will occur this next round of “too big to fails.”This time the “too big to fails”won’t be some puny, billion dollar company, it will be trillion dollar nations. I have said that there is quadrillions of dollars in paper assets and only a few million ounces of real physical silver on the market. Right now, there is probably less than 1% of people invested in silver,what will the price of silver be if it went back to 15% of the population like it did in the 80′s? Don’t forget the last time precious metals went up it was really only the Western nations that participated in that bull run. This time, it is truly a global reality with China leading the way.

3. Silver retailers will be stunned as people throw their fiat dollar for real tangible metals. Some retailers will celebrate and sell everything they have at higher and higher prices. They will expect to buy back in at a lower price, but this time instead of correcting, it keeps going up. After a short while these former precious metals players will see that the world changed and that they were on the wrong side of the trade. They will then become one of those panic buyers that they once celebrated selling to.

4. The smart silver retailer will see mentality shift of these silver buyers and take silver off of the market. They will see a mentality that is not one of a monetary or freedom “nerds”. It is not the mentality of a momentum monkey trying to make a quick buck trading metal. It will be one of wide eyed sudden panic that people’s entire life’s savings are at risk and that they need to buy silver (or other real assets.) These new buyers will not be letting go of their silver anytime soon,because they will no longer trust the dollar,the stock market,the banks,or the government. The smart retailer will now see that the real money is not selling the metal,but in holding the metal. The longer they hold it,the more that they may never sell the metal for paper money again. They will join the rest of the strong handed investors that will not sell until there is a new monetary paradigm established or they can sell/leverage their silver directly for other income producing assets.

5. Momentum monkeys, who play the paper markets on real assets, will seize upon the new mentality a drive the paper markets higher as they smell blood in the silver short water. Hedge funds will jump all over this market as they seek to squeeze every dollar out of the silver market. Vast paper wealth will be made in a very short time. These momentum monkeys will fail to see that while they were right on the trade but they were in the wrong vehicle. The paper market will cheat them of their ultimate reward of wealth. The mentality shift in asset values that will send real assets soaring at the same time all paper asset markets fail. Even if the momentum monkeys are “right”with their long silver bet…

7. Institutional silver sellers will take their silver off the market. Most people do not realize that the recent depletion of silver on the CRIMEX from 41 million ounces to 28 million ounces has NOT been from people buying and taking delivery of physical silver. It has been from cancellation of warrants of sellers no longer wishing to sell. This is a huge factor from the supply side of silver that will push the price up further.

8. Miners will no longer seek to rush to push more real metal into the paper markets. If they do sell their metal they will most likely sell it in Asia where there will be a huge demand for the metal. These miners will also see that like OPEC or DeBeers,there is great power in restricting output of their product. Most silver is merely a byproduct of mining other metals. Smart miners would be wise to sell their zinc or other metals and keep their silver byproduct as profit. This silver would grow in value and not be taxed. Since they never sell it,there is no tax on its increasing value. This increasing value would be monetized through the appreciation of their stock price as their balance sheet becomes more and more attractive. (Somewhere,someone is smiling at this thought…)

9. Corporations who were once comfortable with paper contracts guaranteeing delivery of their metal, will only want immediate physical delivery. Silver is such a strategic metal and is used in such small quantities. There are billions of dollars in corporate valuations at risk if corporations cannot secure the basic components for their products. Companies like Apple computer will whip out the big check book for only the real thing. Corporations will use their power to create a stock pile which will add further demand. Most likely they will bypass the paper markets all together and deal directly with the corporations who mine the silver. What a power shift that will be when tech giants have to go hat in hand to a small mining company to get their metal. Who knows,maybe these tech giants will use their wealth and just buy the whole mining company…

10. Mining nations will make their move. So many mines are in nations that can and will,at the drop of a hat,nationalize mines. Nations will be facing tremendous social upheaval and will not hesitate to steal wealth from the mines that rest in their lands. China once the largest exporter of silver only 5 years ago is now the largest importer of silver. Bolivia was on the verge of nationalizing their mines last May,they could pull the trigger anytime they want. Even in the United States,do you really think the thieves in Washington will not steal the mines in America? Or the CRIMEX or the SLV? Or even it’s citizens?

For the record,I do not think they will go for the little guys like us. First the majority of silver holders are smart enough to hide their silver beyond the sight the Federales. Second,the majority of silver owners I know are former military,gun owners who don’t trust the government. They would never willingly give up their silver anymore than they would give up their guns,food or children. If they won’t give it up,what are they going to do send in the SWAT team to grab some Mercury dimes? Finally,I believe that the government will have much bigger problems on its hands with riots and starvation to mount any effort for confiscation. All of this assumes that these bozos even understand how important silver is.

11. The Anti-Hegemon makes it’s move. I have written that there is a group of nations that have not benefited from the current world order and are seeking a way to end it. They have been very wise to not agitate the mortally wounded beast of the Anglo American Empire. They have been sitting on the side lines sharpening their knives waiting for the right time to carve up the remains. China is leading these nations with their huge reserves and the opening up of new markets like the Pan Asian Gold Exchange and the Hong Kong Mercantile Exchange. These nations have been using their paper assets to buy real assets all over the world. China is now in every continent buying oil,farms,and mines. They do not waste their wealth on frivolous showcase properties like the Japanese did when they bought golf courses and Manhattan sky scrapers. They are buying assets that will be the basis of power in the new paradigm of real wealth.

This mentality shift in real asset values will ultimately lead to a paradigm shift in power. Those that have the real assets will be the ones making the rules. Those investors who hold the physical metal will finally have the upper hand over the paper manipulators. Those miners will finally become more valuable then these frivolous companies like Facebook. Those nations that have the natural resources will have the upper hand economically over nations that have nothing else to offer but debt and death. This shift is power will be from those that produce nothing to those that produce something. Reality will take hold and the day of something for nothing will be over for good.

When the game changes you will see that the counter party risk becomes the most important aspect of investing. Paper assets rely on another party to fulfill their end of the bargain,real assets do not. When the world is panicking, it will be every man for himself. There are many more powerful people higher up the food chain that will get theirs before you get yours. A very wise man,Ponce,once said. “if you don’t hold it, you don’t own it.”When this shift happens, will you be in the right place, at the right time? Got physical silver?

Source

I predicted that silver, at one point, would not be available at any dollar price. You can throw away all of your $50, $100, $500 price targets, because society would finally see the enormity of the fraud in the silver market. Once this fraud exposed,no person on earth would dare let go of their silver for fiat paper money. Sure a couple of ounces might be available at the local shop, but the vast majority of the silver markets will be as barren as the shelves of a post collapse Soviet Union grocery store. This global mentality shift in asset values will lead to a paradigm shift where the world no longer wants debt money. Only real money will do in the new paradigm.

1. Physical investors who have been stacking physical silver will be stunned by the sudden appreciation. It will be akin to someone winning the lottery. They will shocked at the enormity of their new found wealth which occurs at the same time the economy becomes an absolute horror show. A shift in the perception of wealth will confirm that they are holding something truly precious. The years of being told they are crazy for buying silver will finally give way to, “you were right.”After the shock wears off, these newly minted kings will seek to make the most off of this once in a life time opportunity. These men were astute enough to buy silver when everyone said they were nuts, they are certainly now not going to give up what they have for some dirty dollars that they did not want years ago. They will wait for something much, much better. They will not see immediately many opportunities to invest their new wealth in, because the final throes of the debt based economy will be horrific. No one will invest when it is not certain what will happen to humanity. They will have no choice but to wait until the act plays out and the music stops.

2. Long term paper investors who have been sitting on the sidelines, will rush to buy silver this time around. I cannot tell you how many people I know that are literally dragging their feet buying silver. ( You know who you are.) They understand why to buy, but it is just so hard for them to pull the trigger. Unfortunately,it will not be until much higher prices that they will finally pull the trigger. When they do buy, they will be joining a fast and furious rush as those fence sitters finally panic for the exits. They will see that Europe’s debt problem, is the world’s debt problem. We cannot solve debt with more debt. They will see a world awash in more debt/money. They will see that no paper asset is safe with the amount of money printing that will occur this next round of “too big to fails.”This time the “too big to fails”won’t be some puny, billion dollar company, it will be trillion dollar nations. I have said that there is quadrillions of dollars in paper assets and only a few million ounces of real physical silver on the market. Right now, there is probably less than 1% of people invested in silver,what will the price of silver be if it went back to 15% of the population like it did in the 80′s? Don’t forget the last time precious metals went up it was really only the Western nations that participated in that bull run. This time, it is truly a global reality with China leading the way.

3. Silver retailers will be stunned as people throw their fiat dollar for real tangible metals. Some retailers will celebrate and sell everything they have at higher and higher prices. They will expect to buy back in at a lower price, but this time instead of correcting, it keeps going up. After a short while these former precious metals players will see that the world changed and that they were on the wrong side of the trade. They will then become one of those panic buyers that they once celebrated selling to.

4. The smart silver retailer will see mentality shift of these silver buyers and take silver off of the market. They will see a mentality that is not one of a monetary or freedom “nerds”. It is not the mentality of a momentum monkey trying to make a quick buck trading metal. It will be one of wide eyed sudden panic that people’s entire life’s savings are at risk and that they need to buy silver (or other real assets.) These new buyers will not be letting go of their silver anytime soon,because they will no longer trust the dollar,the stock market,the banks,or the government. The smart retailer will now see that the real money is not selling the metal,but in holding the metal. The longer they hold it,the more that they may never sell the metal for paper money again. They will join the rest of the strong handed investors that will not sell until there is a new monetary paradigm established or they can sell/leverage their silver directly for other income producing assets.

5. Momentum monkeys, who play the paper markets on real assets, will seize upon the new mentality a drive the paper markets higher as they smell blood in the silver short water. Hedge funds will jump all over this market as they seek to squeeze every dollar out of the silver market. Vast paper wealth will be made in a very short time. These momentum monkeys will fail to see that while they were right on the trade but they were in the wrong vehicle. The paper market will cheat them of their ultimate reward of wealth. The mentality shift in asset values that will send real assets soaring at the same time all paper asset markets fail. Even if the momentum monkeys are “right”with their long silver bet…

- there is nothing stopping the CRIMEX from changing the rules for paper traders capping their gains.

- there is nothing stopping a failure of their brokerage account or their bank as the paper markets seize.

- there is nothing stopping people from not accepting their paper “winnings”for the real physical silver.

- there is nothing stopping the very dollars they “won”from not having any value at all.

7. Institutional silver sellers will take their silver off the market. Most people do not realize that the recent depletion of silver on the CRIMEX from 41 million ounces to 28 million ounces has NOT been from people buying and taking delivery of physical silver. It has been from cancellation of warrants of sellers no longer wishing to sell. This is a huge factor from the supply side of silver that will push the price up further.

8. Miners will no longer seek to rush to push more real metal into the paper markets. If they do sell their metal they will most likely sell it in Asia where there will be a huge demand for the metal. These miners will also see that like OPEC or DeBeers,there is great power in restricting output of their product. Most silver is merely a byproduct of mining other metals. Smart miners would be wise to sell their zinc or other metals and keep their silver byproduct as profit. This silver would grow in value and not be taxed. Since they never sell it,there is no tax on its increasing value. This increasing value would be monetized through the appreciation of their stock price as their balance sheet becomes more and more attractive. (Somewhere,someone is smiling at this thought…)

9. Corporations who were once comfortable with paper contracts guaranteeing delivery of their metal, will only want immediate physical delivery. Silver is such a strategic metal and is used in such small quantities. There are billions of dollars in corporate valuations at risk if corporations cannot secure the basic components for their products. Companies like Apple computer will whip out the big check book for only the real thing. Corporations will use their power to create a stock pile which will add further demand. Most likely they will bypass the paper markets all together and deal directly with the corporations who mine the silver. What a power shift that will be when tech giants have to go hat in hand to a small mining company to get their metal. Who knows,maybe these tech giants will use their wealth and just buy the whole mining company…

10. Mining nations will make their move. So many mines are in nations that can and will,at the drop of a hat,nationalize mines. Nations will be facing tremendous social upheaval and will not hesitate to steal wealth from the mines that rest in their lands. China once the largest exporter of silver only 5 years ago is now the largest importer of silver. Bolivia was on the verge of nationalizing their mines last May,they could pull the trigger anytime they want. Even in the United States,do you really think the thieves in Washington will not steal the mines in America? Or the CRIMEX or the SLV? Or even it’s citizens?

For the record,I do not think they will go for the little guys like us. First the majority of silver holders are smart enough to hide their silver beyond the sight the Federales. Second,the majority of silver owners I know are former military,gun owners who don’t trust the government. They would never willingly give up their silver anymore than they would give up their guns,food or children. If they won’t give it up,what are they going to do send in the SWAT team to grab some Mercury dimes? Finally,I believe that the government will have much bigger problems on its hands with riots and starvation to mount any effort for confiscation. All of this assumes that these bozos even understand how important silver is.

11. The Anti-Hegemon makes it’s move. I have written that there is a group of nations that have not benefited from the current world order and are seeking a way to end it. They have been very wise to not agitate the mortally wounded beast of the Anglo American Empire. They have been sitting on the side lines sharpening their knives waiting for the right time to carve up the remains. China is leading these nations with their huge reserves and the opening up of new markets like the Pan Asian Gold Exchange and the Hong Kong Mercantile Exchange. These nations have been using their paper assets to buy real assets all over the world. China is now in every continent buying oil,farms,and mines. They do not waste their wealth on frivolous showcase properties like the Japanese did when they bought golf courses and Manhattan sky scrapers. They are buying assets that will be the basis of power in the new paradigm of real wealth.

This mentality shift in real asset values will ultimately lead to a paradigm shift in power. Those that have the real assets will be the ones making the rules. Those investors who hold the physical metal will finally have the upper hand over the paper manipulators. Those miners will finally become more valuable then these frivolous companies like Facebook. Those nations that have the natural resources will have the upper hand economically over nations that have nothing else to offer but debt and death. This shift is power will be from those that produce nothing to those that produce something. Reality will take hold and the day of something for nothing will be over for good.

When the game changes you will see that the counter party risk becomes the most important aspect of investing. Paper assets rely on another party to fulfill their end of the bargain,real assets do not. When the world is panicking, it will be every man for himself. There are many more powerful people higher up the food chain that will get theirs before you get yours. A very wise man,Ponce,once said. “if you don’t hold it, you don’t own it.”When this shift happens, will you be in the right place, at the right time? Got physical silver?

Source

14 Jul 2011

Silver Is Rarer than Gold

Most investors assume that because silver is almost 50 times cheaper than gold, it's more abundant.

They're wrong.

The amount of available silver is far rarer than the amount of available gold.

This fact is often overlooked by even the most seasoned silver investors. And it's this lack of silver stockpiles that has become one of the most critical factors in what could jolt prices, lifting silver into an entirely different asset class all together.

So forget $100 silver — $100 is now considered a timid prediction. Some experts are now calling for silver prices to be on par with gold!

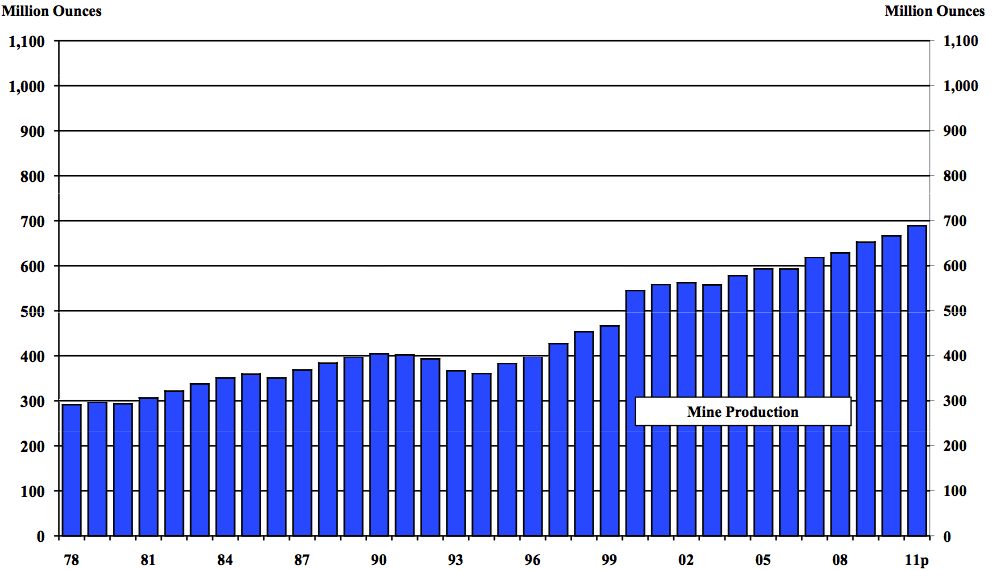

Let me quickly explain how we got here. Global silver mining has increased significantly over the past two decades.

Silver output has more than doubled since the early 1990s in places like Mexico, Australia, and Peru. Other countries have seen even more dramatic production spikes. In China, a relatively new major supplier of the metal, silver mining has scaled up from less than 10 million ounces in 1991 to more than 100 million ounces today.

Overall, the world's total silver mining production has increased from 400 million ounces in the early 1990s to about 700 million ounces today.

But despite a sharp increase to supplies, the global demand for silver is far outpacing global production.

In fact global silver production has be unable to meet global demand for more than fifteen years. The world's silver mines are simply not producing enough silver to meet demand.

In 2010, global silver demand exceed 1.05 billion ounces; but as you saw in the chart above, global mining has only provided about 700 million ounces.

So how has the market been filling this deficit?

Over the last two generations, major government stockpiles of silver have been sold off to supply the industry. The United States government alone has dumped nearly 5 billion ounces of silver into the market since WWII.

Of course, any government's well of silver reserves are finite. And over the past few years, government supplies of silver have been drying up. Data from the Silver Institute shows net government sales of silver falling drastically in the past decade.

This is one of the major reasons it is critical to act now.

Without government stockpiles to feed it, the market only has few other places to buy its silver. Scrap metal is one option for the market, and will continue to help supply rising demand in the near term. But this well will also quickly run dry — and that will create a real problem for consumers who need silver...

Silver is Actually Rarer than Gold

Silver is 17.5 times more abundant in the Earth's crust than gold. But the amount of above-ground gold far exceeds the amount of silver.

In 1950, there were 10 billion ounces of available silver above ground. By 1980, that number shrank to 3.5 billion. And today, no significant government stockpiles of silver exist anywhere in the world. The USGS actually lists the U.S. government's current stockpile of silver simply as: “None.”

The exact opposite is true of gold. In 1950, there were an estimated 1 billion ounces of above-ground gold. Today, there are nearly 5.8 billion ounces across the globe.

The world currently produces about 700 million ounces of silver per year.

So where does it all go?

Believe it or not, most of it winds up as garbage. We literally throw billions of dollars' worth of silver in trash bins every year.

Silver is required in the production of products like CDs, cell phone batteries, calculators, printed circuit boards, hearing aids, electronic switches, TV screens, catalytic converters, inks, computer monitors, RFID chips, and thousands more. Once any of these items have served their purpose, they generally get tossed. And it's simply more expensive to recycle the silver from these products than it is to dig more out of the ground.

Tiny bits of silver in electronics are thrown away every day.

I expect that the world's trash dumps will be a precious source of resources like silver in the future.

You see, gold is produced, but it's not consumed. Even though gold is a highly desired item, it's not an industrial commodity.

In other words, gold is desired, but silver is needed.

All of the gold that has ever been mined is basically still around. Studies suggest that 98% of all gold mined throughout history is still available in either coins, bars, artifacts, and jewelry. But silver is different.

From 1990 to 2000 alone, over two billion ounces of silver disappeared from the market to consumption.

Despite the lack of global stockpiles, new technology will continue to discover more industrial applications for silver, putting a further strain on world supplies. Consider the new photovoltaic industry as an example...

In China, the production of photovoltaic solar panel has doubled every single year since 2003. The demand for silver from the global photovoltaic industry has soared in the past few years, and global demand is expected to reach 150 million ounces per year by 2015 — just to satisfy the photovoltaic industry.

In the meantime, American Eagle Silver bullion coins continue to move at a record-setting sales pace. The latest sales figures indicate the U.S. Mint sold over total of 3.4 million Silver Eagles in June. This figure earned the title as the "Best Ever June," and ranked seventh place in all-time monthly sales.

This is all very much in line with reports from other mints around the world, which have also seen a huge surge in silver coin sales over the period.

There's no doubt the silver market will have to face a serious deficit. And in order to balance the deficit, silver will have to come from somewhere...

I believe the majority of this silver will come from investors. And for investors to sell, we'll need to see higher prices.

The world has been drawing down its above-ground supply of silver for decades, diminishing the only source of what is available for investment. And only now have we begun to collectively recognize silver as a solid investment.

This is the perfect market for silver prices to appreciate. Global supply deficits continue to be ignored year after year by investors. This is slowly changing, but owning silver has not gone mainstream yet...

Even as premiums rise and available retail supply dwindles, there is still time. The opportunity in silver is huge.

I maintain that the very best form of silver you can own is physical — and in your personal possession.

Source

They're wrong.

The amount of available silver is far rarer than the amount of available gold.

This fact is often overlooked by even the most seasoned silver investors. And it's this lack of silver stockpiles that has become one of the most critical factors in what could jolt prices, lifting silver into an entirely different asset class all together.

So forget $100 silver — $100 is now considered a timid prediction. Some experts are now calling for silver prices to be on par with gold!

Let me quickly explain how we got here. Global silver mining has increased significantly over the past two decades.

Silver output has more than doubled since the early 1990s in places like Mexico, Australia, and Peru. Other countries have seen even more dramatic production spikes. In China, a relatively new major supplier of the metal, silver mining has scaled up from less than 10 million ounces in 1991 to more than 100 million ounces today.

Overall, the world's total silver mining production has increased from 400 million ounces in the early 1990s to about 700 million ounces today.

|  |

| click to enlarge source: CPM Group | |

But despite a sharp increase to supplies, the global demand for silver is far outpacing global production.

In fact global silver production has be unable to meet global demand for more than fifteen years. The world's silver mines are simply not producing enough silver to meet demand.

In 2010, global silver demand exceed 1.05 billion ounces; but as you saw in the chart above, global mining has only provided about 700 million ounces.

So how has the market been filling this deficit?

Over the last two generations, major government stockpiles of silver have been sold off to supply the industry. The United States government alone has dumped nearly 5 billion ounces of silver into the market since WWII.

Of course, any government's well of silver reserves are finite. And over the past few years, government supplies of silver have been drying up. Data from the Silver Institute shows net government sales of silver falling drastically in the past decade.

| 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | |

| Net Government Sales (million ounces) | 63.0 | 59.2 | 88.7 | 61.9 | 65.9 | 78.5 | 42.5 | 28.9 | 15.5 | 44.8 |

This is one of the major reasons it is critical to act now.

Without government stockpiles to feed it, the market only has few other places to buy its silver. Scrap metal is one option for the market, and will continue to help supply rising demand in the near term. But this well will also quickly run dry — and that will create a real problem for consumers who need silver...

Silver is Actually Rarer than Gold

Silver is 17.5 times more abundant in the Earth's crust than gold. But the amount of above-ground gold far exceeds the amount of silver.

In 1950, there were 10 billion ounces of available silver above ground. By 1980, that number shrank to 3.5 billion. And today, no significant government stockpiles of silver exist anywhere in the world. The USGS actually lists the U.S. government's current stockpile of silver simply as: “None.”

The exact opposite is true of gold. In 1950, there were an estimated 1 billion ounces of above-ground gold. Today, there are nearly 5.8 billion ounces across the globe.

The world currently produces about 700 million ounces of silver per year.

So where does it all go?

Believe it or not, most of it winds up as garbage. We literally throw billions of dollars' worth of silver in trash bins every year.

Silver is required in the production of products like CDs, cell phone batteries, calculators, printed circuit boards, hearing aids, electronic switches, TV screens, catalytic converters, inks, computer monitors, RFID chips, and thousands more. Once any of these items have served their purpose, they generally get tossed. And it's simply more expensive to recycle the silver from these products than it is to dig more out of the ground.

Tiny bits of silver in electronics are thrown away every day.

You see, gold is produced, but it's not consumed. Even though gold is a highly desired item, it's not an industrial commodity.

In other words, gold is desired, but silver is needed.

All of the gold that has ever been mined is basically still around. Studies suggest that 98% of all gold mined throughout history is still available in either coins, bars, artifacts, and jewelry. But silver is different.

From 1990 to 2000 alone, over two billion ounces of silver disappeared from the market to consumption.

Despite the lack of global stockpiles, new technology will continue to discover more industrial applications for silver, putting a further strain on world supplies. Consider the new photovoltaic industry as an example...

In China, the production of photovoltaic solar panel has doubled every single year since 2003. The demand for silver from the global photovoltaic industry has soared in the past few years, and global demand is expected to reach 150 million ounces per year by 2015 — just to satisfy the photovoltaic industry.

Silver Demand from the Photovoltaic Industry

But to widen the supply deficit even more, the Silver Institute forecasts industrial uses of silver will rise sharply over the next five years. The organization estimates that by 2015, the demand for silver from industry will increase 36%.

Meanwhile, the demand for silver for jewelry and investment is reaching record levels. A survey of 340 retail jewelers representing ~4,000 individual stores recently showed silver jewelry sales hitting record highs. The survey found:- 87% of jewelry retailers said their silver jewelry sales increased in 2010

- 52% said their silver jewelry sales increased between 11% and 25%; 28% saw an increase over 25%

- Retailers rated the following categories as giving them the “best” maintained margin:

- Silver jewelry 57%

- Diamond jewelry 20%

- Bridal jewelry 15%

- Gold jewelry 4%

- Platinum jewelry 4%

In the meantime, American Eagle Silver bullion coins continue to move at a record-setting sales pace. The latest sales figures indicate the U.S. Mint sold over total of 3.4 million Silver Eagles in June. This figure earned the title as the "Best Ever June," and ranked seventh place in all-time monthly sales.

This is all very much in line with reports from other mints around the world, which have also seen a huge surge in silver coin sales over the period.

There's no doubt the silver market will have to face a serious deficit. And in order to balance the deficit, silver will have to come from somewhere...

I believe the majority of this silver will come from investors. And for investors to sell, we'll need to see higher prices.

The world has been drawing down its above-ground supply of silver for decades, diminishing the only source of what is available for investment. And only now have we begun to collectively recognize silver as a solid investment.

This is the perfect market for silver prices to appreciate. Global supply deficits continue to be ignored year after year by investors. This is slowly changing, but owning silver has not gone mainstream yet...

Even as premiums rise and available retail supply dwindles, there is still time. The opportunity in silver is huge.

I maintain that the very best form of silver you can own is physical — and in your personal possession.

Source

Ron Paul to Bernanke: Is Gold Money?

July 13, 2011 - Congressman Ron Paul questions Federal Reserve Chairman Ben Bernanke in a U.S. House Financial Services Committee Meeting shortly after reports surfaced that the Federal Reserve was preparing for a third round of quantitative easing.

25 Reasons To Buy Gold And Dump Dollars

Debt-based fiat money, which implies never ending debt and constant inflation, is not a sound, stable or sustainable monetary system. Major economic problems today, such as rising global commodity prices and the sovereign debt crisis, are not aberrations or inherent problems of capitalism, but are the inevitable consequences of a centrally planned system that, by design, produces never ending inflation, ever increasing centralization of financial power and increasingly extreme concentration of wealth.

Monetary systems that rely on debt-based fiat money can be accurately described as confidence games and the global cartel of central banks that exists today is similar to a criminal cartel, such as the drug cartel, except that the banking cartel has been legalized,can extort hundreds of billions from governments with impunity,and can conjure unlimited trillions out of thin air for its own benefit with no accountability. In stark contrast,hapless billions of people labor worldwide for single-digit hourly wages on an ever faster moving hamster wheel of inflation and debt.

Monetary systems that rely on debt-based fiat money can be accurately described as confidence games and the global cartel of central banks that exists today is similar to a criminal cartel, such as the drug cartel, except that the banking cartel has been legalized,can extort hundreds of billions from governments with impunity,and can conjure unlimited trillions out of thin air for its own benefit with no accountability. In stark contrast,hapless billions of people labor worldwide for single-digit hourly wages on an ever faster moving hamster wheel of inflation and debt.

Read more:

Monetary systems that rely on debt-based fiat money can be accurately described as confidence games and the global cartel of central banks that exists today is similar to a criminal cartel, such as the drug cartel, except that the banking cartel has been legalized,can extort hundreds of billions from governments with impunity,and can conjure unlimited trillions out of thin air for its own benefit with no accountability. In stark contrast,hapless billions of people labor worldwide for single-digit hourly wages on an ever faster moving hamster wheel of inflation and debt.

Monetary systems that rely on debt-based fiat money can be accurately described as confidence games and the global cartel of central banks that exists today is similar to a criminal cartel, such as the drug cartel, except that the banking cartel has been legalized,can extort hundreds of billions from governments with impunity,and can conjure unlimited trillions out of thin air for its own benefit with no accountability. In stark contrast,hapless billions of people labor worldwide for single-digit hourly wages on an ever faster moving hamster wheel of inflation and debt.Like a commodity, supply and demand is the putative basis for the value of money in the field of economics,but many economists and most investors know very little about the underlying structure of the monetary system. The legal and,in a systemic sense,mathematical structure of money is debt,i.e.,a note or debt instrument, thus money is the liability of its issuer (a government or central bank),rather than a tangible asset. Money,which is a purely legal construct (rather than a direct representation of a physical asset or an actual commodity),is created ex nihilo through legal agreements,such as mortgage loans,car loans,student loans,credit card charges,business loans,etc.,hence the term “fiat” money. Governments help banks to create money by borrowing for deficit spending (and by paying interest on the debt),but central banks create money directly through loans to banks or favored parties,debt monetization and asset purchases.

The reality of debt-based fiat money has many implications and consequences. The most important fact is probably that such a monetary system must constantly expand because,when money is debt,interest payments require the money supply (and debt levels) to constantly grow regardless of population growth or sustainable economic activity. In other words,debt-based fiat money systems are inherently inflationary and banks are in the inflation business. Monetary policy must favor inflation so that,overall,interest payments can be met,preventing the system from collapsing in a deflationary spiral of debt defaults. For this reason,the value of the U.S dollar has declined to the equivalent of roughly $0.03 since the founding of the Federal Reserve in 1913. The Federal Reserve’s supposed mandate of price stability is as absurd as it is impossible. In fact,the Federal Reserve itself,through its monetary policies,is the ultimate source of monetary inflation and the most general cause of rising prices.

A debt-based fiat money system,together with the monetary policies necessary to support it,eventually causes debt levels to grow to unsustainable levels, resulting in unsustainable economic aberrations,such as the dot-com and housing bubbles, and producing the boom and bust cycle of credit expansion and contraction, euphemistically called the “business cycle”. Obviously,infinite growth is impossible in a finite world and phenomena that increase by a significant percent per year,e.g., the money supply,increase exponentially,which does not characterize sustainable systems. Without debt-based fiat money,a massive U.S. federal government equal to roughly 35% of GDP,a gargantuan banking industry equal to 20% of the S&P 500,a vast military industrial complex costing hundreds of billions per year,and perpetual foreign wars costing trillions of dollars would be unlikely,if not impossible. Of course,a perfect monetary system has yet to be invented,but debt-based fiat money has more disadvantages than advantages,and the advantages accrue only to a select few.

A Broken Promise

When a transaction for goods takes place using debt-based fiat money one party holds goods and the other holds a note,which is a financial system asset of the holder but a liability of the issuing government or central bank,i.e.,money is a liability,not an asset,of the issuer. The most obvious question is whether the government or the central bank in question is good for the debt. Since fiat currencies are not redeemable,the only way the issuer can be good for debt is in terms of other fiat currencies,all of which decay in value over time. Fiat currencies are backed essentially by the words “full faith and credit” which,in a practical sense,refer to the government’s ability to tax its citizens. In reality,however,the words “full faith and credit” mean that fiat money is backed by hollow promises that history shows will eventually evaporate.

Fiat currencies,which have absolutely no tangible,physical backing or real,lasting value,depend solely and totally on the confidence of their users,exactly like a criminal confidence game. Of course,economics is a social science rather than a hard science but,since there are no mathematical models or equations that can accurately describe or predict all possible human action,confidence cannot be reliably manufactured or maintained through behavioral techniques independent of objective reality. Although fiat currencies can function as a unit of account and as a transaction medium,they fail with one hundred percent certainty as a store of value.

The U.S. dollar became a purely fiat currency in 1971 when the Nixon Administration ended the dollar’s convertibility to gold. In effect,the U.S. defaulted on its international gold debts in 1971,thus the current version of the U.S. dollar was born with a unilateral violation of the Bretton Woods Agreement. From that point,the world financial system quickly devolved into an abstract,mathematical representation of economic activity from which paper profits could be extracted through economic rent seeking,i.e.,manipulation of the financial system,rather than real economic activity. The replacement of redeemable U.S. Treasury certificates with Federal Reserve Notes substituted a promise to pay in gold or silver with a promise to pay nothing. The transaction medium (paper notes) was substituted for the value that it was originally intended to convey (physical gold and silver). Once the gold and silver of the American People was confiscated and the gold window was closed (ending the Bretton Woods Agreement),the global financial system became a closed symbolic system dominated by computer models but decoupled from the real world,with no direct linkage to real goods,tangible assets,or sustainable economic activity. The U.S. dollar continued as the world’s reserve currency simply because it remained useful,not because it was,in any real sense,valuable. Today,the perceived economic strength and political stability of the United States has all but disappeared.

The term rent seeking refers to the extraction of economic value (“rent”) through the manipulation of the social or political environment,as opposed to creating value from genuine economic inputs. Like parasitism,rent seeking involves obtaining wealth without reciprocating any benefit back to society through wealth creation. Debt-based fiat money is an example of economic rent seeking because banks,under the guise of providing necessary financial services,create the vast majority of the principal of any loan ex nihilo (based on reserve ratios set by central banks that typically allow 10:1 or greater leverage),allowing banks to collect interest and principle payments without creating any wealth for society. Unfortunately,the Monopoly money that flows from banks is often imprecisely referred to as “capital” when,in fact,it is debt.

As a currency, gold settles transactions in an absolute sense. When a transaction for goods is settled in gold,there is no residual liability. One party holds goods and the other party also holds finished goods,i.e.,gold bullion. Of course,today,gold transactions can be made electronically,e.g.,via GoldMoney.com. In other words,both parties to a transaction hold physical property with no dependency on a government or central bank. There is no 3rd party liability and the middle man (a government or a bank) is cut out of the deal. Not surprisingly,both bankers and those who favor big government,or who consider government authority to be above the rights of individuals (statists),despise and disparage gold. While nominal gains in asset prices,artificially manufactured by inflation can be taxed,governments have no way to tax gains in the value of money itself and must resort to increasing taxes honestly,which,unlike inflation,requires the consent of voters. As John Maynard Keynes famously said,“By a continuing process of inflation,government can confiscate,secretly and unobserved,an important part of the wealth of their citizens. The process engages all the hidden forces of economic law on the side of destruction,and does it in a manner which not one man in a million is able to diagnose.”

Robbing the Poor through Inflation

Like all other debt-based fiat currencies,the U.S. dollar is dysfunctional as a store of value because it is no longer redeemable,because of the inflationary nature of the monetary system itself,and because both the federal government and the Federal Reserve lack monetary discipline. While the U.S. federal government engages in never ending and ever larger deficit spending,the Federal Reserve engages in debt monetization or “quantitative easing” (commonly referred to as printing money out of thin air),while holding interest rates near 0% to support the banking industry,equities and otherwise unserviceable government borrowing. As a result,the largest U.S. banks,together with Wall Street trading firms of all sizes,engage in rampant financial speculation using excess leverage,thus increasing volatility in stocks and commodity prices while undermining the stability of the financial system. All of the preceding issues increase the money supply independent of genuine economic activity,which is inflationary. The actual result,however,is currently stagflation in the U.S. The real value of wages and savings is falling because currency debasement and related economic and trade disruptions are causing prices to rise,but wages,in nominal terms,have remained flat or have declined due to high unemployment and weak economic growth.

While savvy investors may be able to profit from inflation,the vast majority of people are simply impoverished by stagflation. The income gap between the top 0.01% of Americans and the vast majority is as large today as it was in the 1920’s. Although there can be no objection to wealth derived from hard work,ingenuity and business acumen,the wealthiest 1% of Americans now own more than 33% of all wealth in the United States while the poorest 50% collectively own 2.5%. The growing disparity ultimately stems from the structure of the financial system itself,i.e.,central banking and debt-based fiat money. In other words,debt-based money causes an ever increasing concentration of wealth in the financial institutions to which debt is ultimately owed.

From the standpoint of ordinary workers,currency debasement is like a breach of contract where the agreement to work for a wage is violated by altering the value of the wage retroactively. Inflation transfers wealth to those who first receive newly created money. The Federal Reserve’s quantitative easing and asset purchase programs,for example,literally transfer wealth from Main Street to Wall Street by creating new money to purchase financial assets. Those involved in transactions using newly created money,e.g.,bond traders working for investment banks,bankers,etc.,are rewarded and can immediately leverage their new money to increase their assets or spend their gains at current value on consumption,but the value of previously existing money (in the hands of those who don’t work on Wall Street or for a bank),is diluted when newly created Monopoly money circulates. The result is a growing concentration of wealth in Wall Street trading firms and in banks linked to the Federal Reserve,e.g.,Primary Dealers such as Goldman Sachs and JP Morgan. Conversely,the vast majority of Americans have become systematically poorer. For example,middle income jobs have been replaced with low income jobs and low income jobs now account for 41% of all U.S. jobs.

As Americans became poorer over the last few decades,they also became more dependent on the government,e.g.,44 million Americans rely on Food Stamps and one out of every 6 Americans is on Medicaid. Indirectly,inflation therefore increases government debt. Like the socialist governments of Europe,the U.S. government has made too many promises,both at home and abroad,that simply cannot be kept even if the government were to cannibalize the remaining wealth of the American people,destroying what’s left of the U.S economy in the process. As a result,more money printing is inevitable. Even Gideon Gono,Governor of the Reserve Bank of Zimbabwe,infamous for his role in Zimbabwe’s hyperinflation,has become an outspoken critic of the United States and now supports a gold standard. Gono was awarded the 2009 Ig Nobel Prize in mathematics for “giving people a simple,everyday way to cope with a wide range of numbers by having his bank print notes with denominations ranging from one cent to one hundred trillion dollars” What is important,however,is that the root cause of inexorable inflation to infinity is exactly the legal structure of money as debt with interest attached to it issued by private banks that profit by creating money ex nihilo.

America: A Banker Snuff Film

With one exception,the banking industry operates in the same way as an organized crime syndicate. The exception is that in 1913 a group of bankers manipulated the Congress of the United States into passing the Federal Reserve Act,which made the scam of debt-based fiat money technically legal. The true purpose of the Federal Reserve Act was of course to entice the U.S. government into borrowing money because the government had the power to tax its citizens. Thus,the Federal Reserve Act gave a cartel of banks access to the wealth of American citizens through interest and principle payments made by the U.S. federal government out of tax revenue. The U.S. federal income tax is essentially a tax on American citizens levied by a banking cartel that rose to power in 1913 and that now dominates the government of the United States at all levels. As a consequence,the U.S. economy is maxed out on debt at every level,the U.S. government is held hostage by the banking cartel and the U.S. monetary system is reeling out of control near its logical “end of life.” One might say that bankers have “had their way” with the United States of America.

When governments pursue ambitions financed by debt,such as foreign wars or bank bailouts,against the will of their peoples,they financially enslave their citizens. If a government’s debt is backed by the wealth,labor and property of its citizens,the rights of government supersede the rights of individuals in a way that is incompatible with individual liberty. Specifically,individuals do not have an absolute right to own property,including their own labor. Thus,the labor and property of citizens is the property of the government and,actually,the property of the private banks that hold the government’s debt. This is the fundamental reason for the invention of central banking,i.e.,it allows banks to access the wealth of the people through the government’s power to tax. The result of this corrupt financial structure is a de facto tyranny where an anti-democratic global banking empire,built upon the debt servitude of all peoples,financially controls world governments,making democracy irrelevant,while nearly all-powerful bankers live better than kings.

Gold vs. Debt-Based Fiat Money

When currency debasement inevitably becomes extreme,governments refuse to accept one another’s currencies but,as noted by Alan Greenspan,“…in extremis gold is always accepted.” The International Monetary Fund (IMF),for example,accepts payments in gold for settlement of debts. Greenspan also wrote that “An almost hysterical antagonism toward the gold standard is one issue which unites statists of all persuasions. They seem to sense…that gold and economic freedom are inseparable.” Without gold,banks can turn the financial system into a casino where they are guaranteed to win while ordinary citizens are stripped of their wealth and robbed of their financial futures through inflation. Without gold,governments can pursue endless wars funded by debt and build military empires while private banks that buy government bonds quietly collect the wealth of their citizens. If debt levels rise too high,banks reap huge profits at the expense of the overall economy,leaving behind a hollowed out shell set to collapse. In contrast,gold distributes wealth through the economy (as tangible private property) while fiat money concentrates wealth and financial power in the central bank and its dealers,as well as in the government.

| Gold | Debt-Based Fiat Money | |

| 1. | Gold is a tangible financial asset with no bank or government liability. | Fiat money is a debt instrument or note that is the liability of a government or bank. |

| 2. | Transactions in gold are fully settled. Both parties hold finished goods. There is no outstanding liability. | Transactions in fiat money are not settled. One party always holds a note owed by a bank or government. |

| 3. | Gold certificates or electronic credits in allocated gold accounts are redeemable in a real,physical asset:gold. | Fiat money is not redeemable. While it functions as a medium of exchange,it lacks any backing in terms of real assets. |

| 4. | Gold is,at all times,in all places and under all circumstances,universally accepted as money. | National currencies are accepted according to agreements that,like any contract,can be breached or made legally void. |

| 5. | In extremis,gold is always accepted. | In extremis,such as in a time of war,a national currency (or any form of paper money) may not be accepted. |

| 6. | Gold has intrinsic value. The economic inputs (labor and resources) used to produce a gold bullion coin or bar are still present,preserved as a finished product. | Fiat money has no intrinsic value,except perhaps insofar as paper can be used,for example,as kindling to start a fire. |

| 7. | Gold is rare,valuable and difficult to produce in large quantities. | Fiat money can be printed or instantly created electronically in unlimited quantities and at essentially no cost. |

| 8. | The rate of increase in the above-ground gold supply is,and has been throughout history,roughly the same as the rate human population growth. | The supply of fiat money, because of its inflationary structure,always increases in excess of population growth or sustainable economic activity,thus it is destabilizing |

| 9. | Gold is a consistent measure of value over time and across economies. | No fiat paper currency is or can be a consistent measure of value over time or across economies. |

| 10. | The value of gold,measured in real terms,is stable over long periods of time. | The value of all fiat paper currencies is volatile and always declines in the long run. |

| 11. | Gold is durable and virtually all of the gold ever mined still exists today. | Neither governments,nor banks,nor paper motes,nor even digital media are as durable as gold. |

| 12. | Gold serves as a store of value and a preserver of purchasing power. Its value,in terms of real goods,is about the same today as it was 2000 years ago. | Measured in fiat money, prices inexorably rise. Fiat money inevitably loses value because the supply always increases in excess of population growth and sustainable economic activity. |

| 13. | Under a gold standard,economies can enjoy stability and sustainable growth. Of course they are not automatically immune to economic disruptions,e.g.,due to exogenous shocks. | Money based on debt causes a never ending boom and bust cycle of credit expansion and contraction. Economic disruptions are directly caused by the monetary system itself. |

| 14. | Central banks,sovereign nations and investors of all sizes buy gold because its value is more stable than that of fiat money. | The value of fiat money inevitably degrades over time,thus the wealth of fiat money holders is eroded (by inflation). |

| 15. | Gold has been regarded by virtually all peoples as the highest form of money throughout history (for at least the past 5000 years). | Fiat money became the de facto international standard after 1971,only four decades ago. |

| 16. | As a currency,gold cannot fail because it is a real,physical commodity. | Fiat money systems always, eventually fail. All fiat currency schemes throughout history failed. |

| 17. | Over thousands of years, gold has remained a de facto global standard largely outside the control of central banks or governments. | Fiat money was created because it can be centrally controlled and manipulated by banks and governments to suit their own particular needs. |

| 18. | Gold enables people to shield their wealth from the collapse of governments and financial institutions. | If a government collapses, its currency becomes worthless. Governments cannot truly guarantee the wealth of citizens against a banking system collapse. |

| 19. | Gold enables people to protect the fruits of their labor from confiscation by governments or banks through inflation and,therefore,to pass their wealth down through generations. | Inflation is like a breach of contract where holders of fiat money are robbed of its value over time through inflation. If cash is passed down through generations it becomes less and less valuable over time. |

| 20. | Gold safeguards economic freedom and allows people to hold their wealth outside the reach of governments and banks. | Fiat money allows governments or banks to arbitrarily decide the value of money and the financial fate of every person dependent on the currency. |

| 21. | Gold distributes wealth and financial power to the people. | Fiat money concentrates wealth and financial power in banks and in the government,opening the door to limitless abuses. |

| 22. | Under a gold standard, governments cannot expand disproportionately relative to the underlying economy. The optimal size of government is perhaps 20% of GDP. | Central banking was conceived in part to allow governments to expand,e.g.,to fund foreign wars through debt. Fiat money allows governments to grow to unsustainable levels. In the United States,combined government at all levels is equal to roughly 45% of GDP. |

| 23. | Gold prevents the banking industry from expanding disproportionately relative to the underlying economy. | Fiat money allows the banking industry to expand to a point where it dominates the economy and government, and is a crushing,economic rent seeking burden on the economy. |

| 24. | Gold makes it relatively difficult for countries to pursue military adventures or to fund a large military-industrial complex. | Fiat money allows governments to engage in wars and to build military empires as long as their currencies and debts are accepted. |

| 25. | Gold is a real commodity and naturally supports the free market. | Fiat money entails central planning of the economy,i.e.,“monetary policy,” which opposes free markets. |

Centralization and Systemic Instability

Central banking and debt-based fiat money require central planning of the economy,which is not only ineffective but diametrically opposed to free markets,individual economic freedom,and democracy. Central planning of the economy leads to systemic instability because human beings,who make monetary policy decisions,are invariably fallible. Further,it is simply not the case that a single policy is appropriate for all industries and regions,thus there is not and can never be a correct monetary policy for all economic activity. In other words,the fundamental concept of central banking is flawed independent of the debt-based fiat money scam (except from the standpoint of bankers because debt-based fiat money causes wealth and property to accrue to those who enjoy the extraordinary privilege of creating money).

Thanks to the Federal Reserve,extreme centralization of wealth and financial power is now a reality in the United States. Not coincidentally,the U.S. economy is an increasingly all-or-nothing system that leaves tens of millions behind. Only 66.8% of American men were employed in 2010,the lowest level ever recorded,because permanently unemployed individuals are no longer counted as part of the workforce. Individuals who are willing and able to work have been pushed out of the financial system and forced to depend on charity or on the government. Since unemployment in the United States is a deep,structural problem,permanently unemployed individuals are disenfranchised former members of society,i.e.,part of a permanent and fast growing underclass. To make matters worse,the majority of American households are now net recipients of government transfer payments. Tens of millions of Americans have,in effect,become wards of the state causing the federal government’s deficits and debt level to climb ever higher from record levels. Nonetheless,the more debt the government has,the more wealth and power the banking cartel commands. Interest on the U.S. federal government’s debt cost $413 billion in fiscal 2010 and that number is expected to roughly double over the next decade.

As a point of comparison,the services of bankers cannot actually be worth more to society,in terms of real wealth creation,than the services of those who build businesses,produce real goods and create jobs,but the concept of value is distorted by the nature of the financial system. As a result,bankers may enjoy multi-million dollar bonuses without having added a single new business,product or job to the economy. Arguably,such a financial system is a contrived fantasy world,where bankers,perhaps not unlike Lloyd Blankfein,Ben Bernanke,Jamie Dimon and Timothy Geithner,financially rule the world as its “financial royalty.” Why the public or government officials (ignoring political campaign contributions) place any confidence in these or similarly self interested “financial leaders” and the institutions they represent defies reason. What is important,however,is that the structure of the financial system (i.e.,central banking and debt-based fiat money) ultimately produces financial,economic,social and political instability as a consequence of never ending debt,constant inflation,central planning of the economy,centralization of financial power and extreme concentration of wealth.

Opting Out

Physical gold provides a way to preserve wealth outside of the inflationary currencies of the debt swamped U.S.,European countries and Japan,to name a few. Buying gold is an “opt out” decision,not only rejecting the supposed “full faith and credit” of corrupt governments,but also rejecting the inflation / debt-servitude paradigm of the global central banking cartel that currently has every developed nation in a financial stranglehold. The ancien régime of the U.S. federal government,the Federal Reserve and the U.S. dollar as the world’s reserve currency will clearly fail as a result of its inherent structural flaws. The U.S. monetary system has already begun to break down and is currently being supported by money printing,government deficit spending and by what are,in effect,financial attacks on sovereign nations,thus on their currencies,that make the U.S. dollar appear stronger. Schemes undreamed of may yet prolong the death rattle of the U.S. dollar but the outcome cannot be changed. Like all fiat currencies before it,the failure of the U.S. dollar will leave holders of U.S. currency and of U.S. debt with nothing but ridiculous coupons,like Zimbabwe’s defunct 100 trillion dollar notes. One can only hope that the opportunity will be taken to abolish the Federal Reserve,shut down the global debt-based fiat money scam,and break up the criminal central banking cartel.

Read more:

13 Jul 2011

Fed will launch ‘QE3’ by fall, expert says

WASHINGTON (MarketWatch) — The weak June nonfarm payrolls report will spur the Federal Reserve to launch a third round of asset purchases, known as quantitative easing, sometime this fall, said David Blanchflower, a professor at Dartmouth College.

“QE3 looks increasingly on the table. What are they going to do, let unemployment start rising again?” Blanchflower said in a telephone interview.

Blanchflower, a former member of the Bank of England’s monetary policy committee, said the current U.S. malaise is a rerun of the England economy earlier this year where talk about government austerity made consumers rein in their spending, and businesses then slammed the brakes on investment and hiring.

“The sheer talk of austerity pushed down animal spirits and raised markedly the prospects of further QE. How else are you going to get stimulus?” he asked.

Growth in England is very slow and should be a wake-up call in the U.S., he said.

“All the people arguing that fiscal contraction is expansionary are completely off track,” he said.

The Fed sees an economy that still needs negative real interest rates, but they have to push against members of Congress “who don’t understand that raising fears of financial collapse makes things worse,” he said.

The fiscal mess must be sorted out over a much longer time frame because the economy needs some stimulus in the short-term, he added.

The Fed will wait until after the summer to decide how to do a new round of asset purchases and what to say, he said.

The next round of quantitative easing will be similar to the past two rounds because the Fed is extremely limited in what assets it can purchase, he said. The Fed has the authority to buy only Treasurys, mortgage-backed securities or short-term municipal bonds, Blanchflower said.

The Bank of England may launch another round of asset purchases before the Fed.

Other ideas floated as easing steps for the Fed just won’t work, he said.

For instance, having the Fed promise to keep rates low even longer than an extended period “is not very credible,” he said.

Looking past jobs data

Optimists hoping for good news out of the monthly jobs report have their faith shaken, but the Street is already looking to next week's earnings season.

“What that means is ‘we’ll keep rates low until we don’t need to keep rates low,’” he said.

Although interest rates are low, most people can’t get banks to offer them a loan because of their credit ratings, he said.

Blanchflower said the slowdown in the U.S. is due to a weak global economy where retail sales are “in a collapse-mode” and consumers and manufacturing data have been negative.

“The world economy is slowing. Why does everyone think the U.S. is separate from it?” he asked.

Blanchflower criticized the European Central Bank decision to raise interest rates.

There is no wage pressure and inflation is falling. This makes it harder for countries on the periphery.

“It looks like policy makers are doing exactly the wrong things,” he said.

Subscribe to:

Comments (Atom)