A great deal can be learned about the government’s response to this crisis, as well as the mistaken policies that necessitated it, by analysing a speech delivered by Ben Bernanke on 21 November 2002. At that time, Bernanke was a Governor of the Federal Reserve. The speech, to the National Economists Club, was titled “Deflation: Making Sure ‘It’ Doesn’t Happen Here”. In light of subsequent events, Bernanke’s comments expose his misunderstanding of the state of the US economy, and, in particular, the forces driving it. This is important because the policies he advocated in that speech are the ones that have been employed in this crisis. Those policies were conceived as a solution to an economic situation Bernanke did not understand. Consequently, they will not cure the imbalances that caused the New Depression. In the short run, their effect will be palliative at best. Over the long run, unless combined with new policies to restructure the US economy, they will only exacerbate past mistakes and permanently undermine American prosperity.

Bernanke gave this speech soon after the collapse of the NASDAQ bubble, when deflation threatened the US for the first time since the 1930s. His ideas about how to prevent deflation are important if we are to understand his ideas about curing it. He began by stating, “I believe that the chance of significant deflation in the United States in the foreseeable future is extremely small …” He went on: “A particularly important protective factor in the current environment is the strength of our financial system: Despite the adverse shocks of the past year, our banking system remains healthy and well-regulated, and firm and household balance sheets are for the most part in good shape.”

Bernanke gave this speech soon after the collapse of the NASDAQ bubble, when deflation threatened the US for the first time since the 1930s. His ideas about how to prevent deflation are important if we are to understand his ideas about curing it. He began by stating, “I believe that the chance of significant deflation in the United States in the foreseeable future is extremely small …” He went on: “A particularly important protective factor in the current environment is the strength of our financial system: Despite the adverse shocks of the past year, our banking system remains healthy and well-regulated, and firm and household balance sheets are for the most part in good shape.” The Fed governor went on to discuss the causes of deflation and its relationship to aggregate demand:

“The sources of deflation are not a mystery. Deflation is in almost all cases a side effect of a collapse of aggregate demand—a drop in spending so severe that producers must cut prices on an ongoing basis in order to find buyers. Likewise, the economic effects of a deflationary episode, for the most part, are similar to those of any other sharp decline in aggregate spending—namely, recession, rising unemployment, and financial stress.”

Next, Bernanke suggested it would be far better to prevent deflation rather than to be forced to cure it once it had taken hold, as it had in Japan:

“The basic prescription for preventing deflation is therefore straightforward, at least in principle: Use monetary and fiscal policy as needed to support aggregate spending, in a manner as nearly consistent as possible with full utilization of economic resources and low and stable inflation.”

According to Bernanke, then, deflation is caused by a collapse in aggregate demand and can be prevented by using monetary and fiscal policy “to support aggregate spending”. But he does not address the question of why aggregate demand would collapse in the first place. Nor does he explain why the economy cannot be righted by market forces but instead must rely on government intervention to hold off deflation.

These questions are too important to overlook. Deflation took hold in the US in the 1930s and in Japan in the 1990s because policymakers in those countries failed to prevent credit bubbles from forming there in the 1920s and the 1980s. Credit bubbles cause aggregate demand for goods and services to expand far beyond the point that can be sustained by the underlying income of society. That is why aggregated demand collapses when the credit bubble pops. Therefore, it must be understood that deflation is the consequence of misguided government policies that allow the formation of credit bubbles. Bad policies were responsible for the NASDAQ bubble. Its collapse produced the deflationary pressures Bernanke was discussing in 2002. Bad policies are also responsible for the deflationary threat now confronting the US following the rise and fall of the housing credit bubble.

Bernanke ended by describing what the Fed could do to cure deflation in the “unlikely” event that prevention did not work and the overnight federal funds rate fell to zero: The following excerpts convey most of his recommendation on the subject.

“We conclude that, under a paper-money system, a determined government can always generate higher spending and hence positive inflation. …

Of, course the U.S. government is not going to print money and distribute it willy-nilly (although as we will see later, there are practical policies that approximate this behavior). Normally, money is injected into the economy through asset purchases by the Federal Reserve. To stimulate aggregate spending when short-term interest rates have reached zero, the Fed must expand the scale of its asset purchases or, possibly, expand the menu of assets that it buys. …

Yet another option would be for the Fed to use its existing authority to operate in the markets for agency debt (for example, mortgage-backed securities issued by Ginnie Mae, the Government National Mortgage Association). …

Historical experience tends to support the proposition that a sufficiently determined Fed can peg or cap Treasure bond prices and yields at other than the shortest maturities. …

If lowering yields on longer-dated Treasury securities proved insufficient to restart spending, however, the Fed might next consider attempting to influence directly the yields on privately issued securities. Unlike some central banks, and barring changes to current law, the Fed is relatively restricted in its ability to buy private securities directly. However, the Fed does have broad powers to lend to the private sector indirectly via banks, through the discount window. Therefore a second policy option, complementary to operating in the markets for Treasury and agency debt, would be for the Fed to offer fixed-term loans to banks at low or zero interest, with a wide range of private assets (including, among others, corporate bonds, commercial paper, banks loans, and mortgages) deemed eligible as collateral. …

Each of the policy options I have discussed so far involves the Fed’s acting on its own. In practice, the effectiveness of anti-deflation policy could be significantly enhanced by cooperation between the monetary and fiscal authorities. A broad-based tax cut, for example, accommodated by a program of open-market purchases to alleviate any tendency for interest rates to increase, would almost certainly be an effective stimulant to consumption and hence to prices.”

While most of those measures were not required in 2002-03, they have been put into effect since 2008. Their purpose is to prevent a contraction of aggregate demand after a credit bubble has burst. This policy is inherently flawed because it fails to recognise that the bubble (and the aggregate demand it created) could not be kept inflated indefinitely by the private sector because the private sector did not have sufficient income to sustain it. It is no cure to use aggressive fiscal and monetary policy to inflate a new credit bubble to replace the one that just burst. The second bubble will be no more sustainable than the first.

The policies employed to prevent deflation and support aggregate demand after the NASDAQ bubble burst were only a mild version of those laid out in Bernanke’s 2002 speech. Aggressive fiscal and monetary measures were implemented that pumped up aggregate demand by fuelling the US property bubble. That approach worked in the short run: the US experienced no significant deflation at the time. Over the long run, however, those policies made matters very much worse. If private-sector income was insufficient to support the NASDAQ credit bubble in 2001, how could anyone have supposed that it would be sufficient to support the much larger housing credit bubble a few years later?

Yes, as Bernanke pointed out, “Indeed, under a fiat (that is, paper) money system, a government (in practice, the central bank in cooperation with other agencies) should always be able to generate increased nominal spending and inflation, even when the short-term nominal interest rate is at zero”. That is certainly true in the short run, but what is the exit strategy? Given the scale of government intervention required to prevent complete economic collapse during the last three years, at this rate, a continuation of the fiat-money bubble-blowing strategy will soon end in nothing less than total collectivization of society.

The policy response to the New Depression has not cured the causes of the economic breakdown, it has merely nationalised the cost of attempting to perpetuate them. Once the bubble began to collapse, there was no realistic alternative to nationalisation. Nationalisation has kept the patient alive. A radically different policy will be required, however, if the patient is actually to be cured.

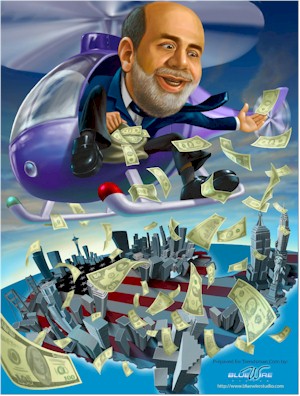

Having dropped $2.3 trillion of helicopter money so far, Washington still does not understand any of this. QE 2 ends today. Expect to hear a loud hissing sound as the global credit bubble begins to deflate. The next round of helicopter money is very likely to begin before the end of the year.

Source

No comments:

Post a Comment