Bailout euphoria has returned to markets with Asian and European stock indices rising on renewed risk appetite.

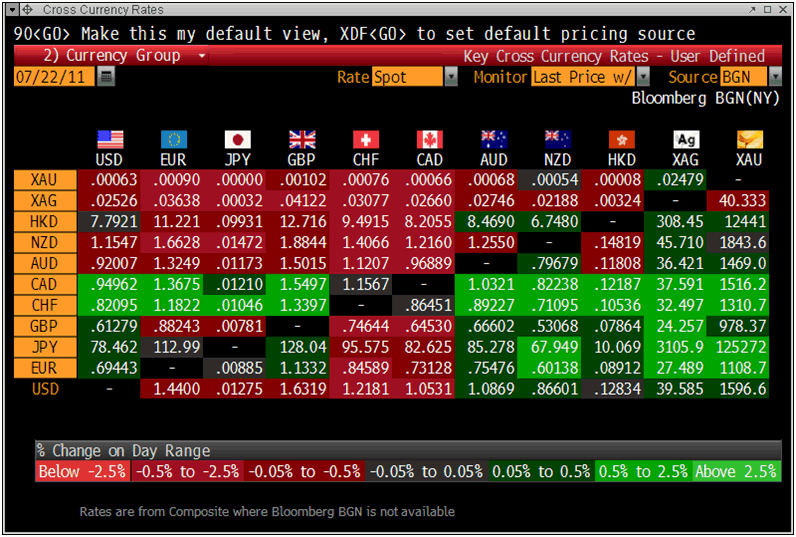

Gold has recovered from yesterday’s slight sell off (0.6% in USD) and the firm gold price in all currencies suggests that market euphoria is again misplaced. Gold is down only 20 euros per ounce in the last 24 hours. Gold is trading at USD 1,596.10, EUR 1,108.1, GBP 978.50 and CHF 1,310.10 per ounce.

Cross Currency Rates

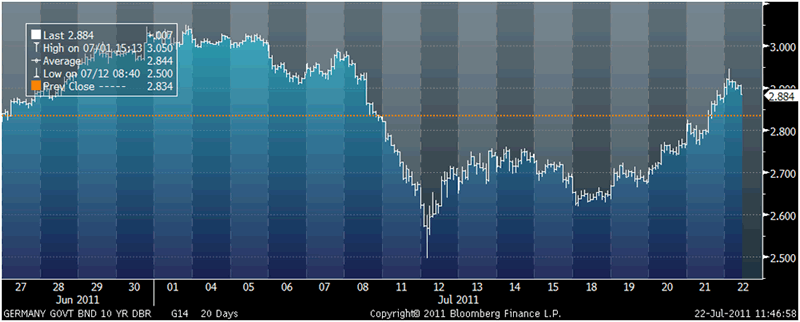

Along with stocks, European bonds are being bought with gusto. Yields in Greece have plummeted while yields in Ireland and Portugal have fallen sharply. German bunds have been sold and the yield on the German 10 year has risen from 2.5% to 2.88% since last Tuesday (July 12th).

The failure to address the risk of insolvency in Greece, Portugal and Ireland means that the risk of contagion has been delayed but remains.

Real contagion risks remain as do currency risks. The dollar and the euro remain vulnerable to further debasement and depreciation.

With all eyes on Brussels, myopia has returned to markets particularly with regard to the serious fiscal and monetary challenges continuing in Washington.

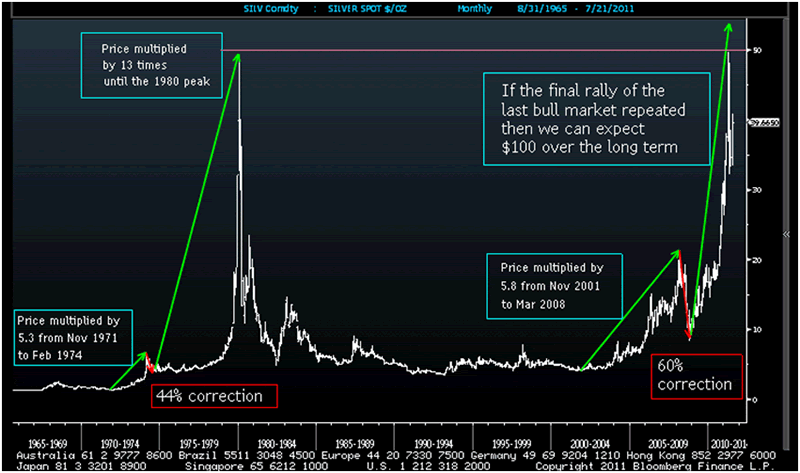

Another sign of silver’s move from the fringe of hard money advocates and more risk averse investors and savers to the mainstream is seen in Citigroup technical analysis of the silver market which was picked up by Bloomberg.

Germany GOVT Bond 10YR DBR

Citigroup Global Markets Inc. have said that if silver follows similar patterns as seen in silver’s last bull market from 1971 to 1980 than silver could double to over $100 per ounce.

“If the final rally in the last bull market repeated then we can expect $100 over the long term,” Tom Fitzpatrick and two other analysts wrote. “While the high so far this year was at the same level as the peak in January 1980, we are not convinced that the long-term trend is over yet.”

Most institutional players and Wall Street banks have been bearish on silver and have called the silver market wrong for years.

Some have very large concentrated short positions which have been investigated by the CFTC and were likely “talking their book.”

Therefore, it is very unusual to see such a bullish call from a major bank and suggests that at least some of the major banks see the writing on the wall regarding much higher silver prices. They are likely positioning themselves accordingly.

This means that the banks with concentrated short positions, such as JP Morgan, may soon see their silver positions incur even greater losses and we may see the much heralded short squeeze propel silver to much higher prices.

Our long held target for silver of $140 per ounce, the real inflation adjusted high from 1980, remains viable and becomes more likely by the day.

SILVER

Silver is trading at $39.72/oz, €27.62/oz and £24.37/oz.

Silver is trading at $39.72/oz, €27.62/oz and £24.37/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,786.50/oz, palladium at $803/oz and rhodium at $1,900/oz

Platinum is trading at $1,786.50/oz, palladium at $803/oz and rhodium at $1,900/oz

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

No comments:

Post a Comment