Foreign governments buy U.S. debt because of the dollar's status as the world's reserve currency – the American economy has long been viewed as a safe place to invest. That's why the amount of U.S. debt held by foreign nations has increased more than six-fold since 2001.

But that's all changing now – events that could spark a U.S. economic collapseare already underway…

The Wall Street Journal revealed this week that China – the largest holder of U.S. investments – is ridding itself of its U.S. government bonds at the fastest rate in history.

In fact, a global sell-off of epic proportion is taking place.

In fact, a global sell-off of epic proportion is taking place.

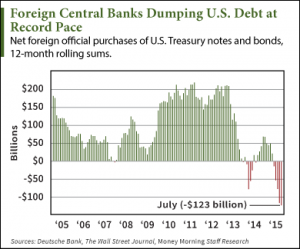

Central banks in China, Russia, Brazil, and Taiwan are selling U.S. government bonds at such a pace that it's caused the most dramatic shift in the $12.8 trillion Treasury market since the 2008-2009 financial crisis.

Foreign official net sales of U.S. Treasury debt maturing in at least one year hit $123 billion in the 12 months ended in July, according to Deutsche Bank Securities Chief International Economist Torsten Slok, reported WSJ. That's the biggest decline since data started to be collected in 1978.

By contrast, foreign central banks purchased $27 billion of U.S. notes and bonds in the prior 12-month period.

Foreign central bankers' massive offloading of U.S. debt sends this dangerous signal…

How Foreign Investors Can Spark a U.S. Economic Collapse

The latest Treasury data (from December 2014) shows that more than one-third of U.S. debt is owned by foreign investors.

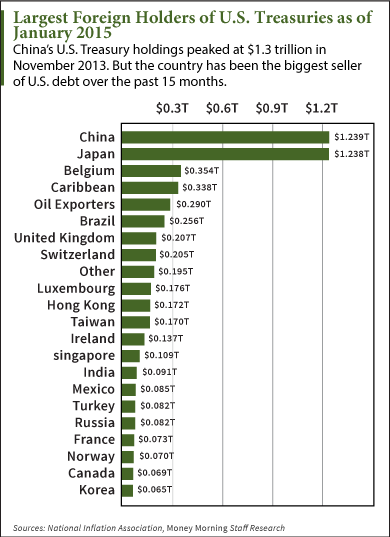

This gives China, along with other major foreign holders of U.S. debt, the power to drastically affect U.S.interest rates.

You see, when foreign governments decide to dump U.S. securities, interest rates go up. That, in turn, makes U.S. debt more risky to buy, which raises rates even higher.

Nonpartisan think tank The Council on Foreign Relations (CFR) explained in June 2010, "A foreign sell-off of U.S. securities could drive up U.S. interest rates and render the nation's formidable stock of debt far more expensive to service…No one knows in advance when the tipping point will be reached, but the damage brought about by higher interest rates and slower economic growth will be readily apparent afterward."

As of November 2013, China held a record $1.317 trillion in U.S. securities. But by the end of July 2015, that amount dipped to $1.241 trillion, according to the latest Treasury data.

Three other of the largest U.S. debt holders are also dumping securities. WSJreports that Russia's holdings of all U.S. Treasury debt fell by $32.8 billion in the year ended in July. Taiwan's holdings fell by $6.8 billion. And Norway reduced its holdings by $18.3 billion.

For now, we haven't seen interest rates shoot up from all this foreign selling because other buyers have stepped in, both in the United States and overseas.

"That buying, driven in large part by worries about the world's economic outlook, has helped keep bond yields at low levels from a historical standpoint," reportedWSJ. "But many investors say the reversal in central-bank Treasury purchases stands to increase price swings in the long run."

"Some analysts have warned for years that persistent fiscal deficits made the U.S. Treasury market vulnerable to a reduction in foreign purchases."

Those analysts include CIA Asymmetric Threat Advisor Jim Rickards. In an August 2014 interview, Rickards told Money Morning that questions over what China will do with U.S. debt is a major concern for Americans.

"The foreigners are now dumping Treasuries and if no one buys it, guess what, interest rates go up," Rickards said. "That'll sink the stock market, that'll sink the housing market. Higher interest rates mean the debt gets higher, so interest rates go up some more."

With these actions, China can take direct aim at the U.S. dollar. And that's just one of the ways China is engaging in financial warfare against the United States.

A global sell-off of U.S. debt is just one of five "flashpoints" that will trigger a U.S. economic collapse. Some of the others are already happening.

Source

No comments:

Post a Comment