Gold and silver have been pretty much the best things to own during the past few years. But the mining stocks…not so much. This is no secret, though why the miners are underperforming is a subject of debate. You hear about high energy prices (though oil is way down lately) and potential nationalizations (though most of the biggest mines are in relatively stable countries). But the most likely explanation is that there isn’t one. Sometimes otherwise strong relationships diverge for a while and then snap back. Wondering why just gets in the way of exploiting the divergence.

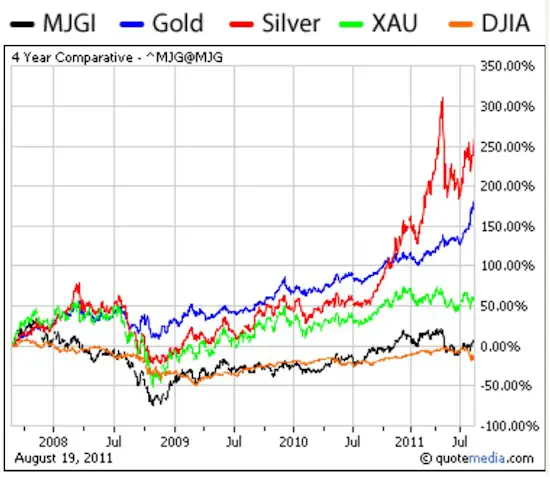

So the real question, assuming precious metals don’t plunge from here, is which miners to load up on? Based on the chart below, it looks like the juniors win hands down:

The black line represents the McEwen Capital Junior Gold Index, a list of mostly Canadian exploration companies that have yet to start producing. This is generally the cheapest type of miner in terms of share price per ounce of metal in the ground, because until they start producing there’s always a chance they won’t. Once an explorer moves successfully into the producer category its valuation frequently pops.

As you can see, these juniors have returned nada in the past three years, which is on a par with the Dow Jones Industrials — a pathetic showing for companies whose metal reserves are worth two or three times per ounce what they were in 2008. In a long-term bull market successful explorers would be expected to outperform the underlying metals. So the upside potential is pretty obvious: If gold and silver hold their recent gains, lots of explorers will either be bought out for nice premiums or start producing and see their reserves revalued to twice or more their current levels.

No comments:

Post a Comment